Highlights From The Comments On British Economic Decline

People are talking about British economic decline.

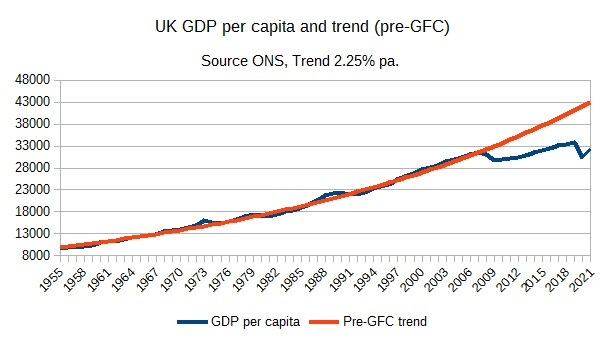

Not just the decline from bestriding the world in the 19th century to today. A more recent, more profound decline, starting in the early 2000s, when it fell off the track of normal developed-economy growth. See for example this graph from We Are In An Unprecedented Era Of UK Relative Macroeconomic Decline:

Source: Mainly Macro

Source: Mainly Macro

Or various articles like The Atlantic’sHow The UK Became One Of The Poorest Countries In Western Europe and Foreign Policy’sBritain Is Much Worse Off Than It Understands - Things Weren’t Nearly This Bad In The 1970s .

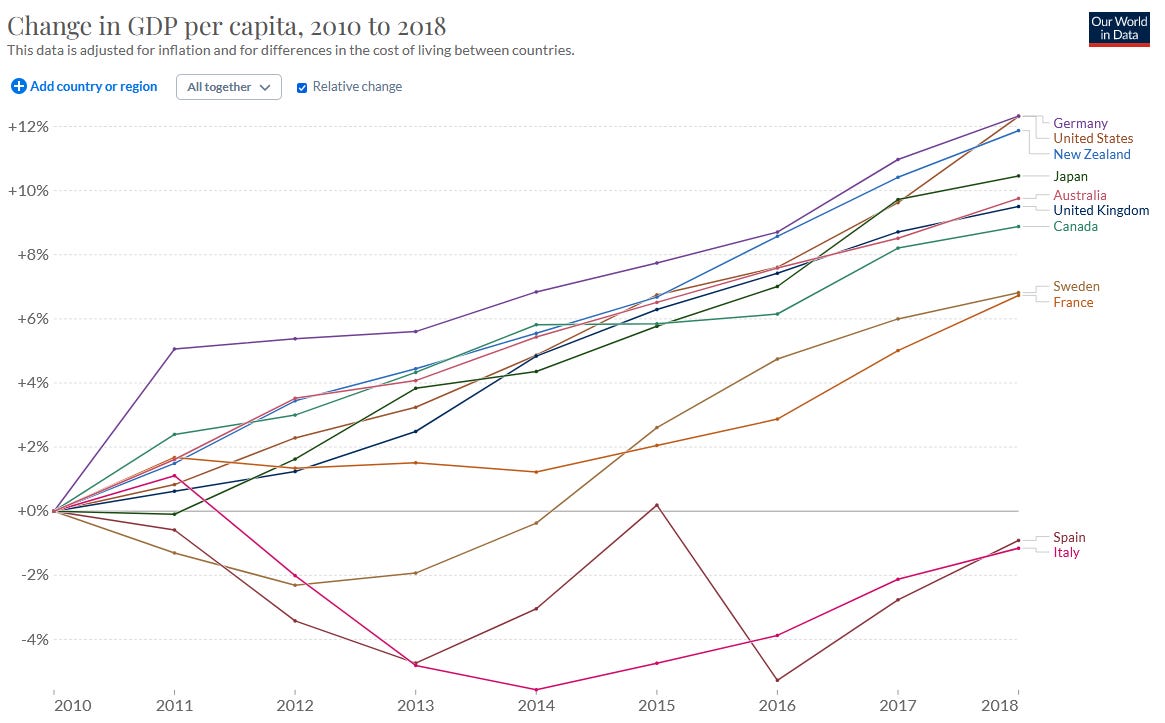

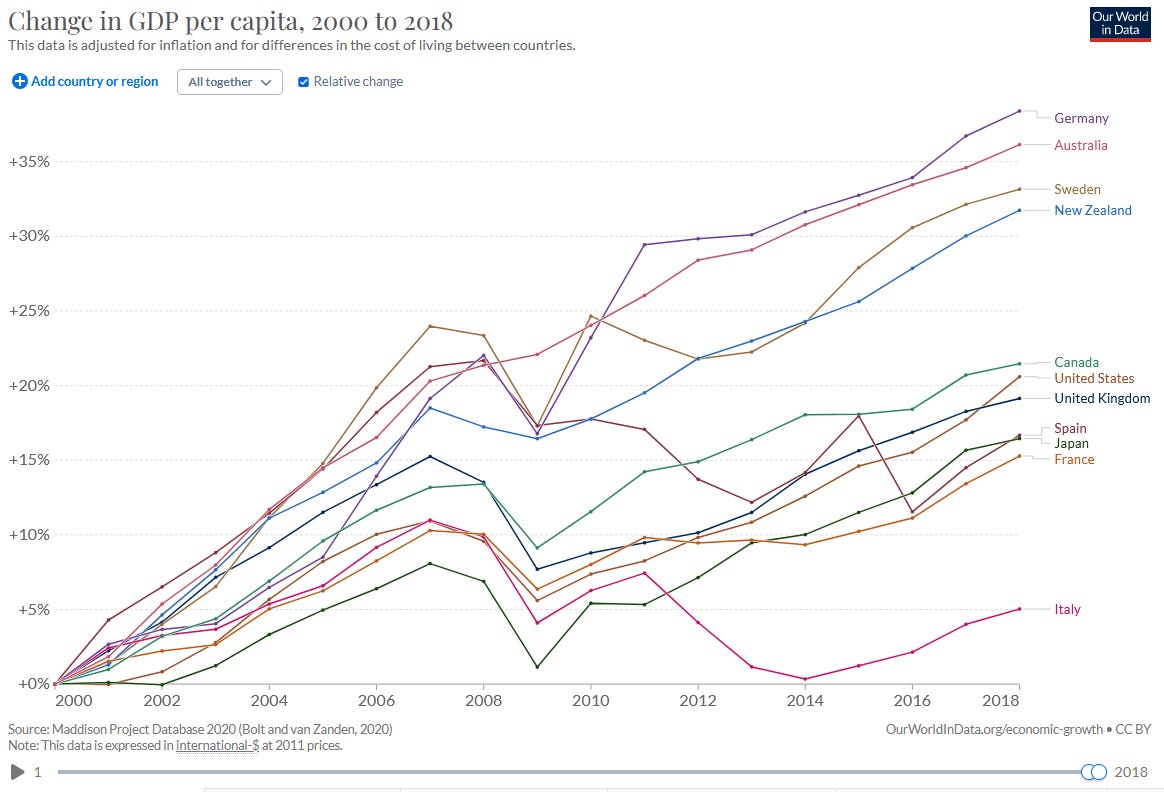

This isn’t clearly reflected in the GDP statistics, which show the UK growing at an average rate for developed countries between 2000 and today:

Source: Our World In Data

Source: Our World In Data

Or between 2010 and today:

I prefer the Our World In Data graphs since they let you clearly show relative growth, but they only go up to 2018. A World Bank graph requires a little more interpretation, but goes up to 2022:

Source: World Bank. Britain is the thick blue line.

Source: World Bank. Britain is the thick blue line.

…and it also shows UK growth being about average.

So what’s going on? I asked about this in an Open Thread. Here were some of your responses.

Eric Rallwrites:

There are two different ways of calculating real GDP per capita in an international context, both of which involve converting local currency to dollars and then inflation-adjusting the dollars based on the US’s GDP deflator. One uses market exchange rates, while the other uses “Purchasing Power Parity”, attempting to optimize the GDP figure as a proxy for standard-of-living by using local prices for equivalent goods and services as the currency conversion factor. For Brexit-related and COVID-related reasons, the relationship between PPP and market exchange rates for Britain have been highly unstable in the period in question: exchange rates have been very volatile (ranging from US$1.08 to US$1.40 per £1.00), and tariffs and COVID disruption have both radically changed the availability and prices of imported goods.

Looking at either the PPP or market exchange rate numbers, everyone took a big hit in 2020, while Britain appears to have taken a deeper hit than France and the overall OECD average (the two control groups I picked off the top of my head). The big difference is that in market exchange rate terms, the recovery looks proportionate to the decline (i.e. Britain fell more, but also recovered proportionately faster so as to bounce back to approximately 2019 levels in 2022 the same as France and OECD):

(source)

But in PPP terms, the UK has recovered at the same rate as France and OECD and thus appears to have permanently (so far) lost ground in standard of living relative to other countries. UK was also growing more slowly in PPP terms between 2015 and 2019 than France, but about the same as the OECD average:

(source)

Putting some numbers on the second graph:

-

Just before COVID, Britain had 106% the average OECD GDP

-

At the peak of COVID, Britain had 101% the average OECD GDP

-

In 2022, Britain still has 101% of the average OECD GDP

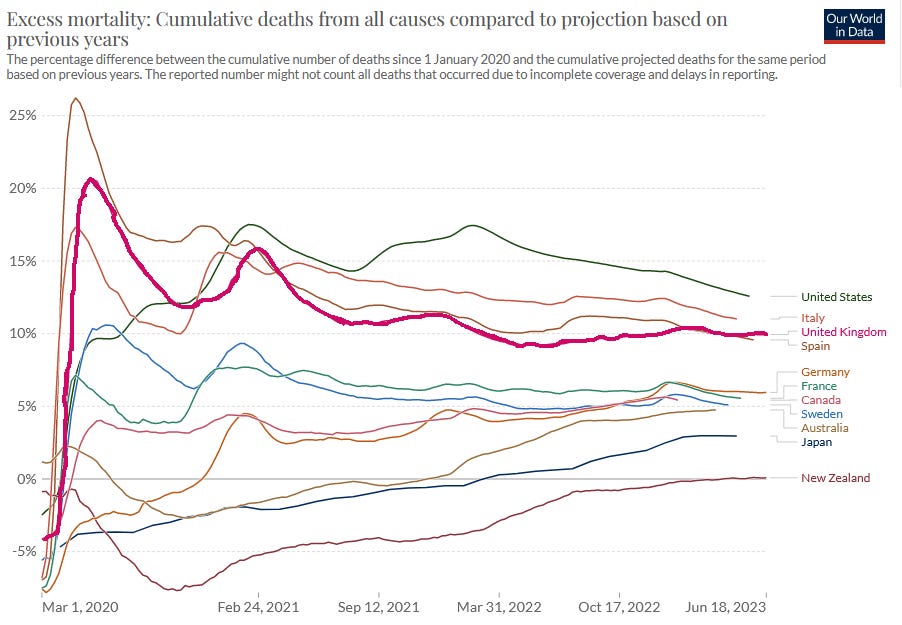

Is this because Britain had a worse COVID experience than other countries, or because they were having a normal COVID experience plus effects from Brexit?

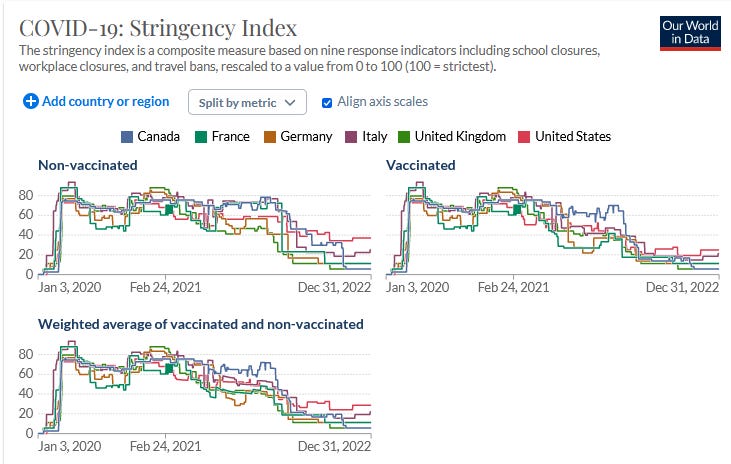

Hard to say. The UK did have an especially bad COVID epidemic, but the US had the worst of all but also had the highest GDP growth, so it doesn’t seem like bad COVID naturally translates into bad economy. Maybe it wasn’t the COVID itself, but the lockdowns?

(source)

(source)

This isn’t the world’s most readable graph, but it suggests UK was no stricter than lots of other places.

So maybe we can summarize Eric’s theory as “The British economy isn’t necessarily worse, but after Brexit, some goods cost more money, so the living standard affordable with the same amount of economic production has gone down.”

Is this economically possible? Suppose that it costs more for Britain to import goods. Some of those goods will be raw materials, which will hurt industry, which will lower production, which should make market exchange rate GDP look worse. I don’t know enough macroeconomics to be able to tell if this should be happening.

AHwrites:

The belief in Britain’s economic decline arises from an understanding of its long-standing, extractive, rentier economy. Post-WWII industrial decline and the subsequent financialisation of the economy have led to a dearth of technical jobs and over-reliance on property ownership, fuelled by planning restrictions that artificially limit supply (and in recent years, mass migration).

Most people’s savings are locked in housing, a non-productive sector. This situation, exacerbated by significant migration and pension funds also being invested in this bubble, leads to chronic underinvestment elsewhere. The government is reluctant to rectify this, as any action deflating housing prices would upset voters.

This results in a precarious cycle. Profits divert to housing and legacy industries, inflating property values and concentrating spending on rent, while investment in productive sectors dwindles. The economy hinges on importing cheap labour to sustain GDP and attract foreign capital, which often funnels into real estate or financial services.

The concern, therefore, is that Britain’s economy rests on unsustainable pillars: a housing bubble, foreign labour, and capital inflow, rather than robust domestic investment and innovation. There is a strong argument to be made that this situation is the result of an inevitable downward spiral since ~1900, when first the aristocracy, and then the government post-nationalisation, decided to sit on industries rather than refine, grow, invest. And then the big sell off and shut down of industry in the 1980s was chosen rather than trying to protect and modernise what we had left. I suspect the collapse of human capital after WW1 exacerbated this issue.

And not to be too doomerist about the whole situation, but the feel on the ground is certainly one of general malaise. Even in London there is a general decline- property used to be expensive, it is now exorbitant, rents were kinda bad, they are now catching up to property prices. The job market is ok, but is entirely focused on professional services, with a small tech sector and a huge swathe of service jobs. Leave London and the feeling is one of awful decline since the mid 2000s boom, with Manchester perhaps an exception.

Something I think illustrates the situation in Modern Britain well- over the last 5-10 years, many UK cities skylines, previously remarkably low, with the odd office building or council tower block, have filled with swathes of garish student housing blocks. The remarkable growth of the Leeds skyline, now filled with cheap student accommodation, sums up the problems with our current capital allocation- billions spent on building non-permanent, suitable only for 18-21 year olds, modern tenement blocks, with the aim of growing our ‘university sector’- dozens of, putting it politely, ‘second-rate’ institutions, which rely on farming out expensive masters degrees to international students and pile-em-high style courses for British students.

I’d be interested in seeing the “government decided to sit on industries in 1900” thesis fleshed out more. Also the “collapse of human capital after WWI”? Is this just saying lots of people died in WWI? If so, how come this didn’t happen in other deadly wars? For example, lots of Germans died in WWII, but Germany remained an economic powerhouse.

Nolan Eoghanwrites:

1) Some of this is anti Brexit propaganda. I think Brexit is a folly myself, but it’s clear there is a clear attempt to blame it for everything and even to exaggerate it’s affects.

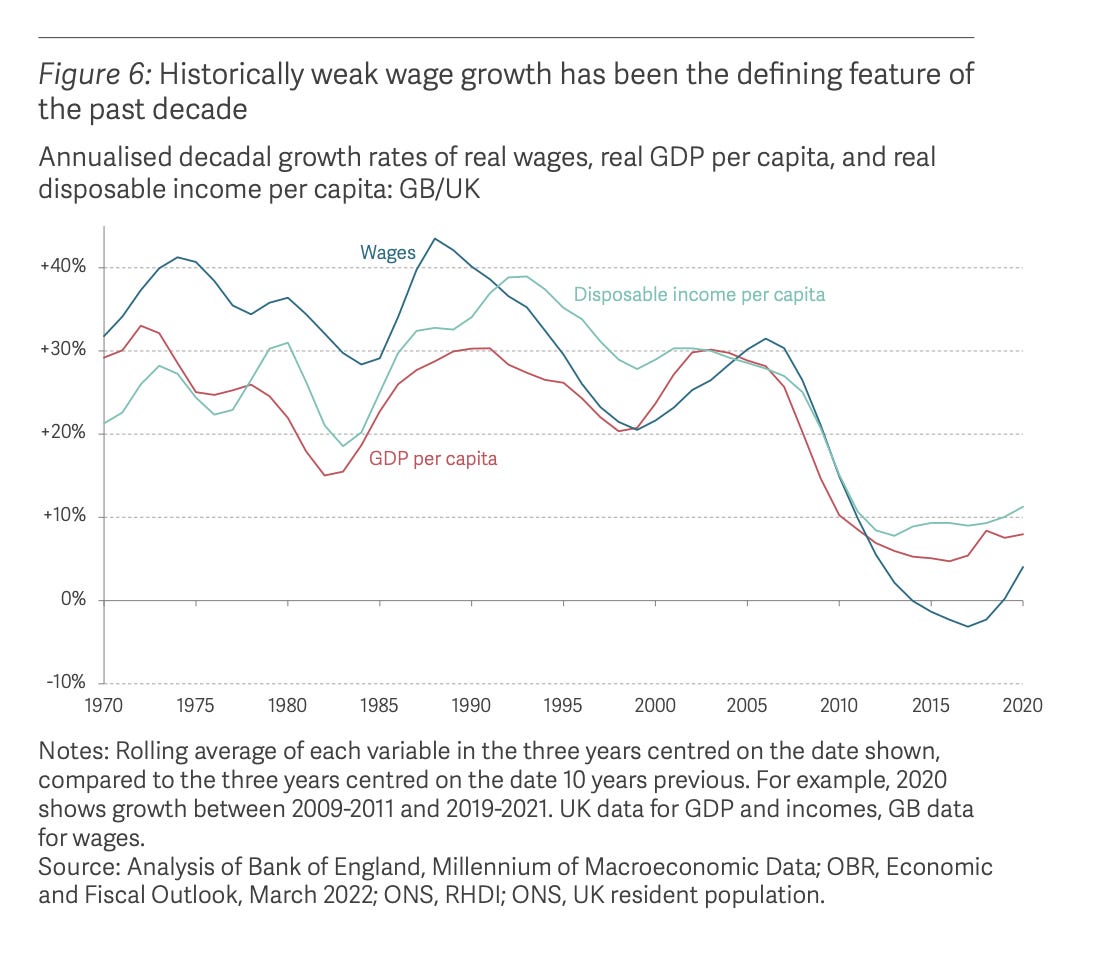

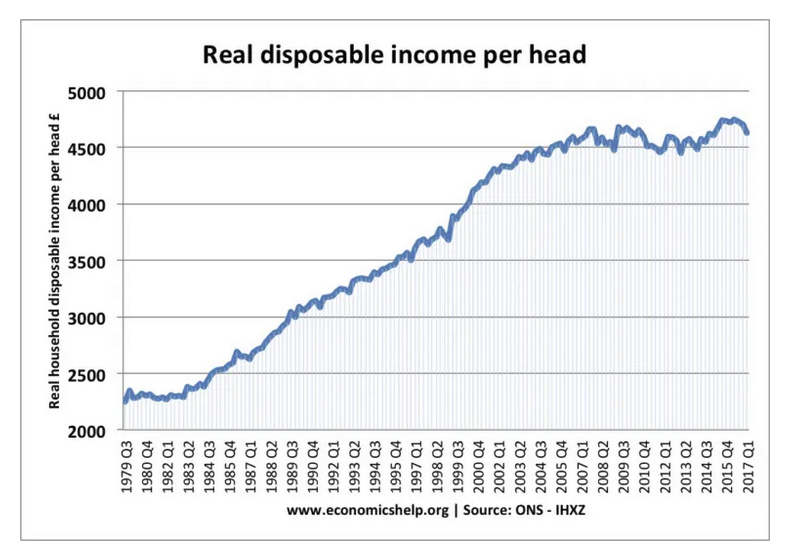

2) that said GDP per capita isn’t everything. Wages gave stagnated in real terms, especially since 2008. They were bouncing back a bit until the recent inflationary period.

3) Britain seems to handled inflation reduction very badly. I might contradict myself here by saying Brexit could have a roll there, but if so why now?

Here is what I was able to find for earnings:

(source)

(source)

But also:

(source)

(source)

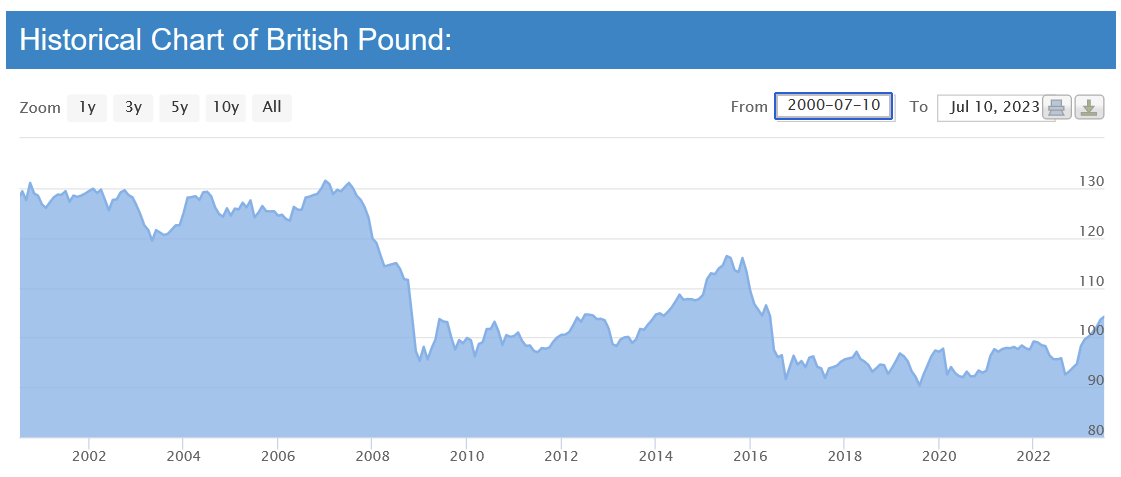

The first graph is nominal, the second is real. Was there a big decline in the value of the pound around this time?

Value of pound relative to a “basket of currencies” (source)

Value of pound relative to a “basket of currencies” (source)

Yeah. Is that the whole story?

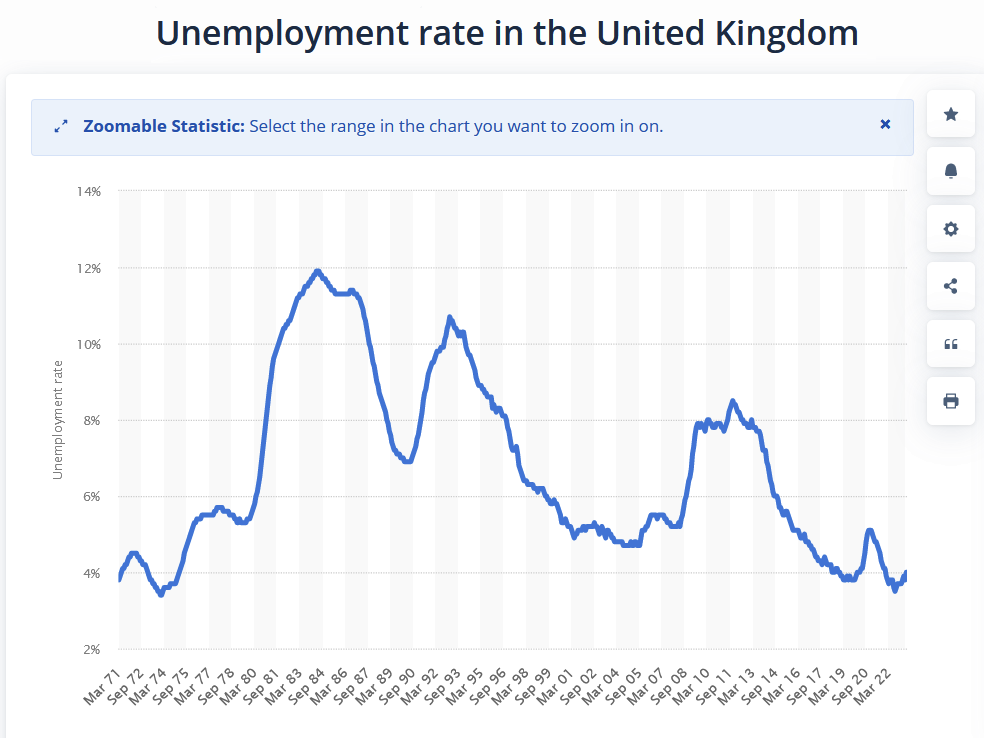

This article calls it a “paradox” that GDP per capita is rising but wages are stagnant. It explains the paradox by arguing that rising GDP is coming from more workers being employed (ie unemployment rate going down), not by employed workers making more money. Instead of increasing productivity per worker, companies can just hire more workers. They attribute this pattern to a combination of Brexit (because companies have less capital to invest in productivity improvements) and austerity/welfare reform (which gets previously non-working people to work).

(source)

(source)

Stagnating UK productivity (source)

Stagnating UK productivity (source)

Smithwrites:

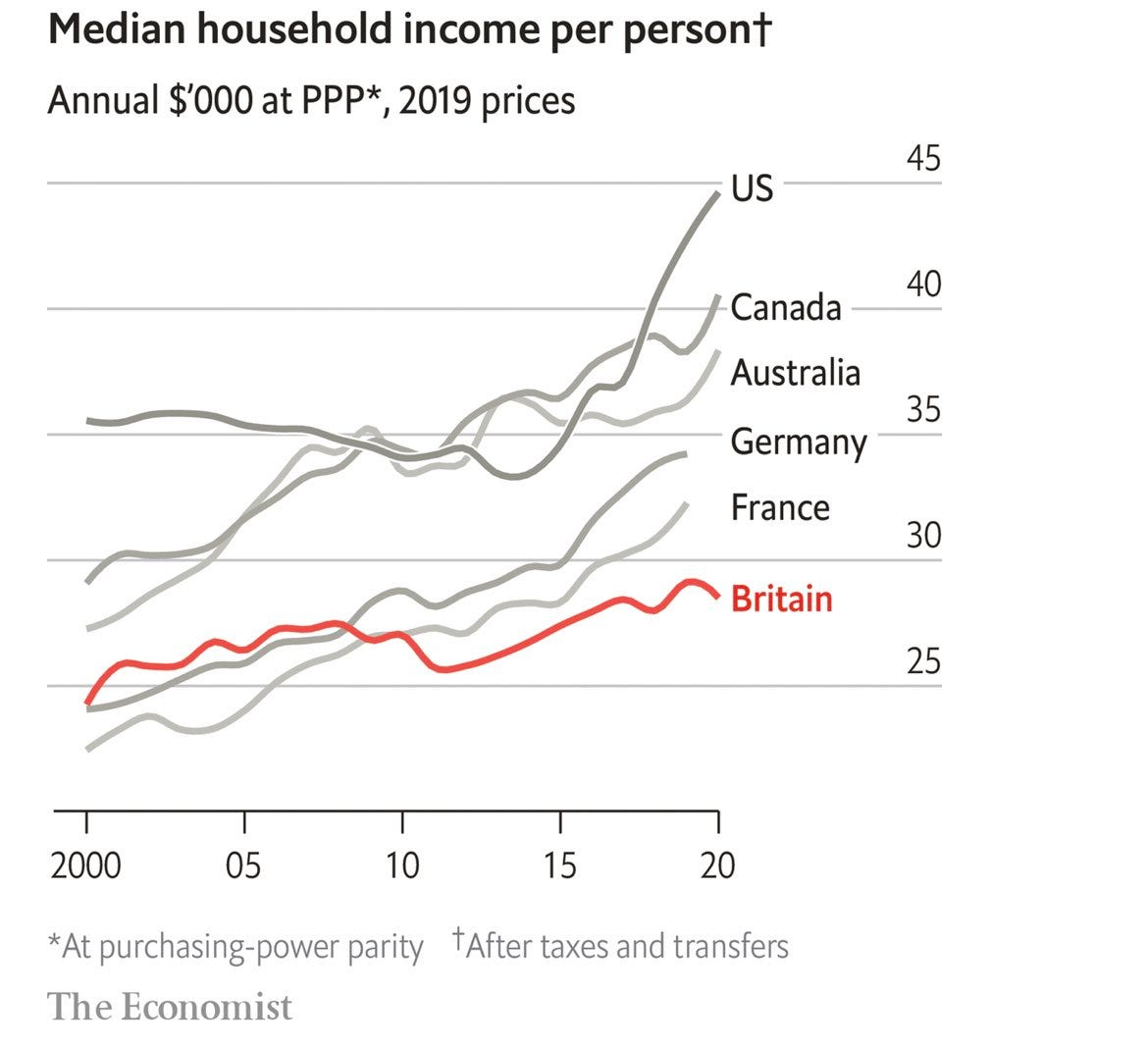

As a Brit I’m not sure I would say we are becoming a third world country, but the last 10/15 years have been pretty bad. You can see this in the gdp per capita stats:

…[in the] 2000s we were similar to Germany, now we are similar to France. [You can also see it in] public services (which have gone from being fairly decent to completely dysfunctional, try getting a non life threatening illness dealt with or any response from the police) and house prices now 9x average earnings, leaving many young people to be paying a very high share of their income of rent.

I think particularly for the smart/driven things have changed from a sense of you can achieve your dreams here (in the same way you can in US or maybe Germany and parts of east Asia) to the sense it’s more like much of Europe where you have to leave to make something of yourself (becoming a France or Italy, full of old people on massive pensions with little growth or dynamism). In the 2000s you could make ridiculous amounts of cash in finance if you worked hard, now it’s a pretty bad deal. Most other industries you would be much better off in the US either as an employee or setting up your own company (e.g. McKinsey associate in London earns £95k, in New York earns $185k with bigger bonus). Hard to think of many successful UK companies that have been created in recent years (Deliveroo, Sky, Ocado?). When I try to explain to American friends that £35k is considered an enviable salary when graduating university they all assume I’m joking. I think the average salary of an Oxford undergrad five years after graduating is around £50k.

Personally I’m somewhat optimistic, partly because the last few years we’ve been paying the costs of brexit (now shouldn’t be as much of a drag, and might even be some benefits from being outside EU regulatory nonsense), a lot of the UK industries have some prospects for growth (tech, pharma) and others unlikely to massively decline (law, finance, insurance). Ultimately think British political elite will fix it as they’ve done in the past, can take them a while but typically they ultimately take the difficult decisions.

I don’t find the GDP stats listed here very convincing; in the context of the other GDP stats we’ve gone through, this looks more like Germany separating from Britain and France, rather than Britain doing anything unusual. But I appreciate the insight into how things feel.

Why are salaries so much lower in Britain, though? And why aren’t more companies relocating to Britain to get cheap British workers?

Citizen Penrosewrites:

Adam Tooze wrote a piece about the decline.

Tooze’s piece includes some graphs that express the problem more clearly than most of the ones I could find:

As best I can tell, his explanation is: Britain has very low productivity growth. Probably this is because of declining public investment in R&D. Probably this is because of Tory-led austerity programs.

I can’t find a clear graph of all country’s public R&D spending, but I think the US spends $100 billion and Britain spends about £15 billion = $20 billion. But the US economy is about 7x the size of Britain’s, so I think the US has less public R&D spending, as a percent of GDP, than Britain. So even if Britain’s public R&D spending is lower than before, why is this so catastrophic?

I’d also like to understand more about how public R&D spending works. Is the government just funding basic research? Or are they helping companies make products? If the basic research, why are the benefits so limited to the individual country that the research is being done in?

Erusianwrites:

Britain leaving the EU has somewhat slowed economic growth. While some British nationalists deny this even the conservative UK government admits this and has sought free trade agreements with several East Asian countries to offset this. However, pro-EU types have a political incentive to exaggerate the damage because they want Britain to rejoin the EU. Which probably would genuinely have a positive economic effect but not to the degree either Brexiteers or Europhiles want to pretend it does.

Further complicating this narrative is the fact that Europe in general is experiencing economic stagnation. This is not just a relative loss like the US where the US is roughly standing in place in terms of relative economic strength but competitors like China are catching up. It’s declining in importance globally as its economy doesn’t grow significantly while East Asia grows a huge amount. The “smart” Brexiteer case is that independence from the stagnant EU is allowing them to pursue trade deals with the more dynamic east and the US which are ultimately better.

As I see it, Britain’s bet is that being a junior partner of the United States will both give them more success than chaining themselves to Europe and give them more freedom (since the US has no interest in British domestic politics in the way the EU does). To this end, it’s aligning itself with other “individual” US allies like Japan or Thailand and attempting to take a leading role in things like Ukraine or Pacific defense.

I have no idea whether it will work (if I did I would be quite rich). But they are right that the EU has not really dealt with the degree to which they are experiencing economic decline. They really ought to be taking relatively radical action. Though whether Brexit as a specifically radical action is a good idea… well, it’s too early to tell.

My summary:

Britain is suffering a decline in productivity and income which isn’t fully reflected in nominal GDP statistics.

This could be because it’s expressed in a declining pound, rather than in declining nominal wages/profits. I don’t know enough economics to feel like I have good intuitions about declining currency values.

It could also be partly because post-recession economic growth happened more in new employment than in higher wages for the already-employed.

Potential causes are Brexit, a dysfunctional real estate market, and underinvestment in R&D - but low confidence in all of these.