Highlights From The Comments On "How Asia Works"

I made a mistake in the email notifications, so if you didn’t know I wrote a review of Joe Studwell’s How Asia Works earlier this week - well, now you know.

Erusian writes:

1.) Three things stick out here. Firstly, Studwell vastly overstates how damaging land reform has to be to landlords. Taiwan and Japan both bought out landlords with bonds. The bonds became worth less because since government bonds grew more slowly than the economy. But there are still a fair number of wealthy old families around in both countries. The important thing is not the destruction of landlords as a class: it’s putting land into the hands of people (whether smallholding peasants or professional farmers) who own the land, have an incentive to improve it, and whose primary income is gained not by owning land but by producing agricultural products. The two are ultimately equivalent at equilibrium. How you get there is not especially important and paying off the landlords is fine if it works. Likewise, giving land to collectives or to peasant groups (as opposed to individual peasants) doesn’t work very well because it keeps it out of the power of enterprising farmers.

Secondly, he completely ignores the many times land reform failed. East Asia is not unique in its attempts at land reform. It was fairly common in Africa, Eastern Europe, etc. Ukraine and Romania had incredibly fertile soil and it’s hard to think of regimes that eliminated their landlords harder. Yet they haven’t really seen similar effects.

Thirdly, he ignores that peasants will vote for land reform overwhelmingly in any democratic system. His focus on outside institutions is horribly misguided. From the CCP to 19th century Japan, peasant ability to make demands of the political system lead directly to land reform. If land reform is no longer viable in nations where the peasantry is still common, the question I’d ask is why that is. Are they all dictatorships? If so, it’s a problem of democratization. Have they got other political goals? Then that’s a separate issues.

2.) There are some countries which are increasingly skipping directly to service export. However, an industrializing country has a huge internal market for industrial goods (roads, bridges, telecommunication infrastructure, etc) which in turn creates a construction/manufacturing boom even when the primary export paying for the imported machinery is (for example) software development services. This is the case in some of the wealthier Indian provinces. But on the whole, manufacturing is still a pretty good bet.

Another thing: the importance of export markets. These countries need to have markets willing to purchase their goods. If they don’t, export lead industrialization fails. Big imperial nations have options that modern nations don’t. Where do these nations export their goods? To the US. Korea had special deals with the US. So did Japan, Taiwan, Hong Kong, Singapore. And even China got special deals (enough to cause Russian complaints). This may be changing, especially for big countries like China with internally developed markets. But this advocacy for ELI should mention the politics of finding places to sell their goods. Otherwise the idea of “protected at home competing abroad” fails.

In Malaysia, Studwell veers into the shaky ground of being against capital per se. Letting partners get equity in firms is not an issue. Did you know huge percentages of Korean companies were owned by Americans? South Korea was not just stealing their technology, they were moving up the value chain. In partnerships where it didn’t make sense, by learning through transfer deals where it didn’t. There is, of course, an issue with letting companies offshore high tech work and using your people only as menial labor. But this is an issue of structuring the deals and regulations. But of the successful cases, only China broadly prevents you from owning minority stakes in companies. The rest, at most, limited the percentage of foreign ownership. Which is still admittedly not a full free market policy.

3.) Again, he’s ignoring the US here. South Korea’s “crazed” borrowing was underwritten by the US for security reasons. The US actually used its might to get SK cheaper debt at some points. Malaysia was on its own.

Also, he doesn’t mention how this method leads to huge problems in the last stage. Japan’s lost decade was in part due to heavily controlled and underdeveloped financial markets.

Overall, I’m sympathetic to the idea of Export Led Industrialization including tariffs. Though it’s worth pointing out the IMF has a better track record than it’s critics want to admit. You just have to realize first it’s primarily a firefighter: you call the IMF when things have gone wrong. (As, indeed, many of these countries did in the late 1990s and then saw bumper growth.) However, this argument ignores (imo) a lot of factors and tells a story of economic destiny being primarily about internal decisions. Which are necessary but insufficient. It’s right there in the idea of export lead industrialization: you are exporting to OTHER COUNTRIES which means they matter for your internal story.

Nifty775 adds:

Good comment. I came here to point out the dreaded counterexample of Latin America, which tried to do a number of things the East Asian countries did, but mostly failed. Mexico basically carried out the greatest land reform initiative known to man outside of Communism, but did not get the benefits Studwell describes. Argentina & Chile also carried out large-scale land reform, to lesser effect. More importantly, Latin America is very protectionist and has been trying to nurture infant industries for decades- Argentina’s still working on that car industry after 30+ years, not exactly to great results….

I also agree with your point about the asymmetry of ‘free trade’. The US tolerated a number of these countries being highly protectionist while also importing their goods here- developing countries get a special dispensation. Arguably the US still does with China, incredibly! And even India, which is now approaching being the world’s 5th largest economy. I’m not sure that this combination of ‘we tariff foreigners but they accept our goods pretty freely’ can necessarily be replicated.

I greatly enjoyed Studwell’s book, I just think that the East Asian countries simply executed on their plans much better than a number of other countries have

I mentioned in the post how Japan used to be known for shoddy manufacturing, but is now considered a paragon of high-quality manufacturing like Germany. Jack C adds:

At one point German manufacturing was known for shoddy quality, hence the phrase “on the fritz”.

I’m a sucker for cool etymologies, but the experts are skeptical of this one, since Fritz didn’t become a nickname for Germany until a decade or so after the phrase was first used.

Kevin writes:

Studwell’s discussion of industrial policy is broadly convincing but he massively overstates his case rhetorically. The anti IMF position is probably his least defensible point. In the 50s-80s, the IMF indeed recommended free market policies, generally. But the anti IMF position then was Industrial Substitution Industrialization. Their belief was that to develop, newly independent countries should cut themselves off entirely from world trade, to develop new industries behind their own borders. Pretty much everyone agrees now that this approach was a disaster. Even if Studwell were 100% correct in every sentence of the book, it would prove that the IMF critics were totally wrong, and the IMF only needed a change of emphasis.

Then we get the question on how widely his advice could be adopted. He briefly mentions in the Philippines section that, citing from memory, “Some people think they can do nothing, but condemning millions to poverty is no option at all” Well in some moral sense sure, but in a policy sense doing nothing is obviously an option. Elites have almost never pursued industrial policy for altruistic reasons: The success stories are all cases where elite interest lined up with the public interest. For example, South Korea was racially and ideologically homogeneous. Marshall Park in other words required industrialists to make SK rich and defended but didn’t care who they were. Studwell mentions that industrial policy failed in Malaysia in part because of affirmative action, and then ignores that point entirely. The East Asian countries that succeeded only did so because of their homogeneity allowing focus purely on industrialization, plus the fact that the US leaned heavily on them. It’s very unclear that a country could implement the Studwell program against the will of its elites. It isn’t the case that where there’s a will there’s a way. Finally, all of this requires a high quality bureaucracy, which East Asia has a long history of and the rest of the world lacks.

For finance, once again Studwell has a good narrow point but greatly oversells his case. There are two market failures that have been identified with international finance: First, that if developing countries take on debt in foreign currency they will be bankrupted en masse if the exchange rate changes. Second, that banks might pursue unproductive loans (real estate and consumer debt, basically). These could be fixed with narrow laws targeting these problems directly and individually. There isn’t very good evidence that the financial repression associated with East Asian development had a very large impact and it’s likely that you couldn’t convince many countries to adopt it anyway. When it comes to industrial loans, there are tons of studies showing that private banks are much more efficient at making loans than the state. The East Asian approach also leaves tons of overhang, for example in China there are tons of state run banks that are riddled in debt and low quality loans. SK and Japan have had this problem with their banks and massive corporations to a significant but lesser degree.

Studwell believes that since the East Asian approach is good we must convince the entire world to adopt all of it. I would tend to think that since there is very little chance of convincing the world to adopt it, and since it comes with major drawbacks over the long term, we should amend the current system. Developing countries should likely support exporting more and implement a few rules to prevent financial crises. The discussion of the IMF is the most dishonest part of the book: he deals so nicely and only by insinuation towards the IMF economists because if he had to defend the position that the international financial system bankrupted the world, it would be obvious that he is wrong. In fact the current international economic system is exceptionally generous - WTO rules explicitly allow poor countries to subsidize industrialization but forbid rich countries from doing the same. The current system likely needs amendment, but not replacement.

Pseudonymous economic historian Pseudo-Erasmus, who I mentioned in the article as somebody I usually trust on these kinds of topics but who hadn’t weighed in specifically, kindly contributed his thoughts:

21Likes2Retweets](https://twitter.com/pseudoerasmus/status/1409833068874043393)

He also has a longer thread discussing Chinese land reform a little further back; click on the starting tweet for more:

53Likes9Retweets](https://twitter.com/pseudoerasmus/status/1383450654887219202)

Navin Kumar writes:

India is probably the best counter-example to what Studwell is talking about.

For decades, India practiced a variant of socialism in which (among other things) industries were sheltered from international and even national competition for reasons that basically line up with the infant industry argument. The resulting companies weren’t even bad, but when they were eventually exposed to world competition, they collapsed, and others took their place.

Similarly, India had (and still has) a robust set of national banks. The problem was that when the government does get them to give unprofitable loans, it wasn’t to subsidize industrial learning but also to support small farmers, weavers etc. It was as much redistribution as investment.

The argument seems to be “there are knowledge externalities generated when firms start manufacturing” but it’s hard for countries to actually implement this insight (assuming it’s correct) because they don’t know which sectors will generate them, what the right policies are to generate them, and when to stop protecting the firms and expose them to global competition.

(Land reforms are amazing, and the closest thing to a consensus that I can think among developmental economists. It’s one of the few policies that don’t have the “equity-efficiency trade-offs” that one learns about in Econ 101.)

Studwell doesn’t really talk about India, but I think his answer here (which several commenters bring up) would be that India didn’t have “export discipline” (ie force companies to manufacture for the external market in order to make sure they can compete in non-captive markets) and internal competition.

Polscistoic also brings up Esping-Andersen’s “Three Laws Of Sociology”, which are:

1. Some do and some don’t

2. It is always different in the South

3 It never works in India

Nicholas Weininger brings up the counterexample of Britain, which had a kind of anti-land-reform - kick peasants out and give land to wealthy landlords - but then industrialized very successfully. Eric Rall speculates:

I also thought about the Enclosure movement and the Highland Clearances in Britain as counterexamples to the Land Reform as a precondition to Industrialization thesis. But after considering a bit, I think we can salvage a variation of the thesis if we conclude that Studwell misunderstood the active ingredient of Land Reform here.

Studwell seems to arguing that the active ingredients are 1) breaking the power base of the great landlords, allowing a durable shift away from a feudal social model, and 2) converting peasants into more productive and more economically-empowered yeoman farmers. But this clearly doesn’t apply to British “Land Reform”, and @Erusian’s earlier comment argues that #1 at least doesn’t apply to Japan, either. My proposed modification of the hypothesis is that the active ingredient is actually replacing traditional systems of land tenure with Freehold tenure or something like it (Fee Simple, Allodium, etc).

Pre-reform land tenures in most places probably resembled the utterly illegible traditional land tenure systems James Scott described in “Seeing Like a State”, where the landlord might “own” the property, but the tenants had a complex mix of vested rights to the land and obligations to the landlord. These systems probably worked decently well within the context of the societies in which they developed, but they tend lock those involved into the social and economic structure whose assumptions are baked into the land tenure system, and their illegibility means nobody has the power or the incentives to improve or restructure them for the better.

Freehold tenure, on the other hand, gives whoever the freeholder is both the power and the incentives to maximize the economic value of the land. It also makes the land title much, much more legible. Contra James Scott, legibility doesn’t just benefit the State: it also benefits the owner by allowing them to engage in transactions with distant strangers, i.e. to buy, sell, or mortgage land rather than just making static traditional use of it or at most handing it off to a relative or neighbor.

The Enclosures at least (I’m less familiar with the Highland Clearances) fit the bill under this hypothesis. When the primary direct beneficiaries of Enclosures were generally the landlords, the Enclosures still served to convert illegible feudal tenure into legible Freehold tenure.

Among the Asian countries under discussion, I think China’s the closest to a counterexample to my hypothesis, since China reformed first to collectivized agriculture (which is legible to the state, but lacks the non-state benefits of the legibility of freehold tenure, and which terminally diffuses the power and incentive of the owner to improve the land), and then to something more like Leasehold tenure than Freehold. But China’s economic expansion came after collectivization was deemphasized, and the modern system of very long-term leases from the State still has a lot of the advantages of freehold: as with freehold, the leaseholder can make improvements and benefit from them for decades at a time, and the leaseholder can buy, sell, or mortgage leased property.

From Will:

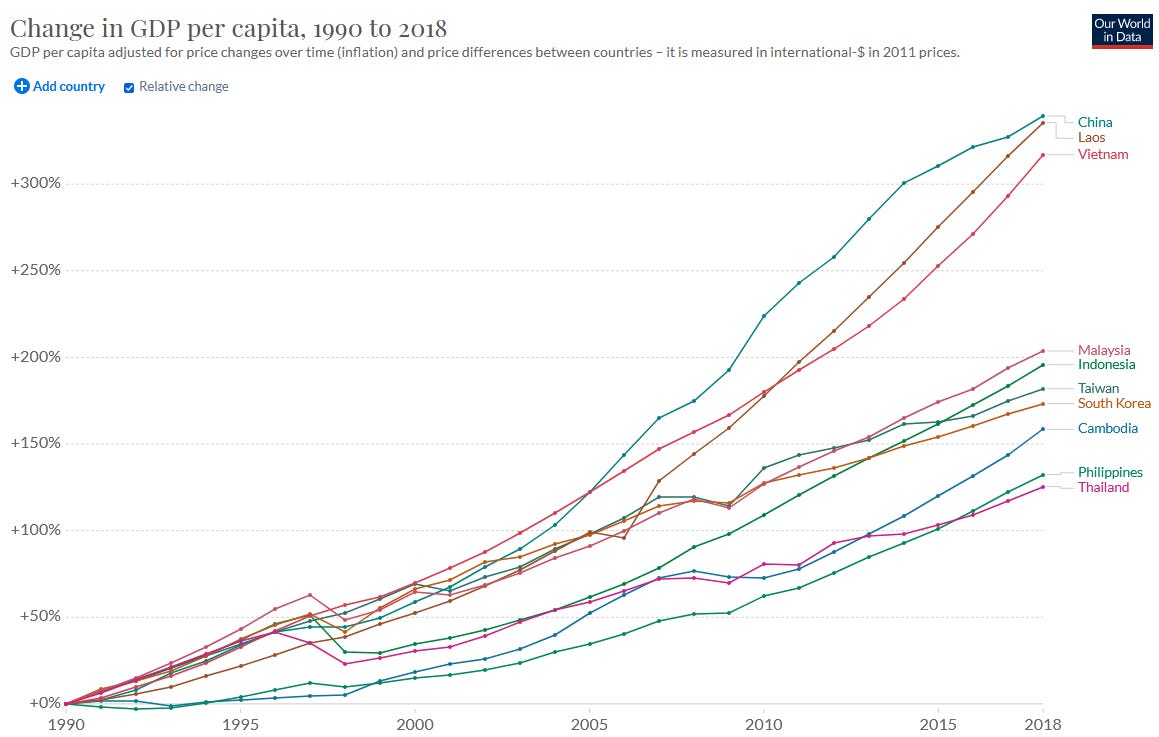

A negative outlook for the South Asian foils (Thailand, Malaysia, Philippines) seems unjustified considering how quickly they are growing at present despite not following the book’s advice. Also they are still richer than their historically more-centrally-planned neighbors Vietnam and Cambodia. In the past 20 years, all the foils have increased their GDP per capita by at least 2.8x, which is a CAGR of at least 5.2%.

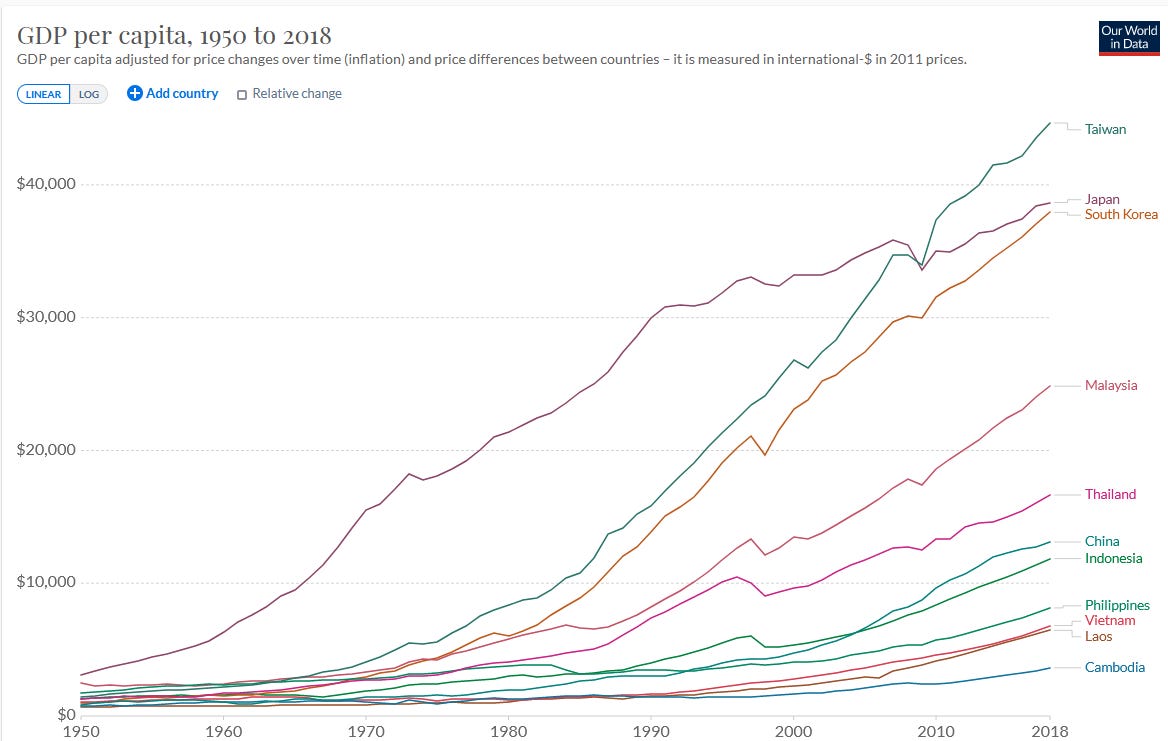

Yeah, this depends a lot on how you look at it. Here’s OWID on absolute GDP growth since 1950:

Here’s relative GDP growth (ie as a percent of starting point) since 1950:

And here’s relative GDP growth with the starting point in 1990:

And here’s relative GDP growth with the starting point in 2005:

Because China, Vietnam, and Laos started so late, they don’t look great on the 1950 plot. They look a lot better on the 1990 plot, and it seems justified putting them in a separate “winner” category compared to “losers” Philippines/Indonesia/Malaysia/etc (South Korea, Taiwan, etc are already too rich to be able to grow fast by this point). If you switch the start date to 2005, then a lot of the gap closes.

I’m not really sure what to do with this. My impression is that the period since 2005 has been a pretty good one for most developing countries, so this might just be the “everyone’s a genius in a bull market” phenomenon. Or it might be that whatever Studwell was picking up on either wasn’t true, or was only true for a certain period.

I should add that including Laos and Vietnam in the same category as Studwell’s other “winners” is my own inference, and not really mentioned in the book, so Studwell would be entirely within his rights saying that China, South Korea, Taiwan, etc had already done well, and Malaysia/Indonesia etc haven’t caught up with them, and nothing that’s happened since 2005 changes that.

There’s a discussion of IQ that retraces all the expected talking points. For example, Alvaro de Menard:

Singapore, Hong Kong, Taiwan, Korea, Japan all have national IQs >=105

Thailand, Indonesia, Philippines, etc. are in the 85-90 range.

There’s an extremely simple theory to explain the development differences we observe. Even if we accept the arguments about industrial policy and land reform, can it really be a coincidence that these policies were only “correctly” applied in the high-IQ countries?

Slight correction - the first list of countries are very high but not quite >105. But more important, Lietadlo asks:

Or is it that developed countries are able to afford better environment for their children and thus produce populations with higher IQ? European IQ scores improved by something like 15 points since WW2. I would guess that Korean IQ scores were abysmal in 1950s as well.

Followed by some examples of this working or not working. Alvaro brings up Gulf states, which got very rich without this changing their national IQ much. Somehow people missed bringing up Ireland, which is the best example of a country whose measured IQ changed a lot after it developed.

Probably the best thing to do is just to check if IQ changed a lot in East Asian countries during their rise to success. The Japanese data (and valiant attempts to extend it to Korea) suggests yes. I don’t think we have the very fine-grained data it would take to try to see how much of these gains are “hollow” vs. important, but in their absence I think it’s fair to speculate that most of the northern vs. southern Asian IQ difference is just that northerners are more Flynn-ified.

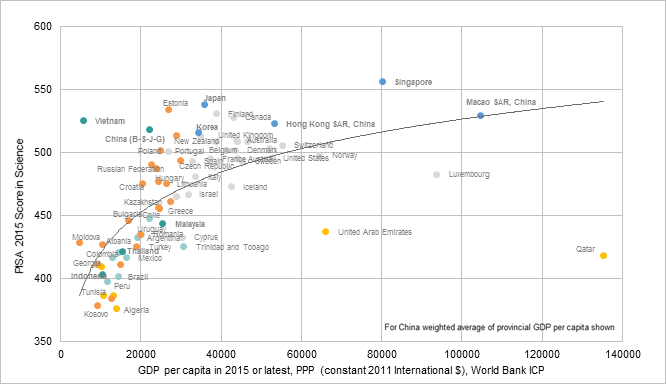

On the other hand, if you compare PISA scores (probably an okay proxy for IQ here) to GDP per capita, you get this:

All East Asian countries are way above the line of best fit, and Vietnam (GDP per capita of like 500) does better than Switzerland (GDP per capita of like 60,000). Meanwhile, Thailand/Malaysia/etc are all much richer than Vietnam and do much worse.

Also of note - if you look at those popular List of Countries By IQ pages, Malaysia, Thailand, and Vietnam all come out about the same! Plausibly PISA is picking something up that whatever terrible methods people use to make those rankings aren’t (or Vietnam cheats on its PISA scores somehow - plausibly China does!) I don’t know if the statistics we use to prove that Japan etc had a Flynn Effect are more like PISA or more like those lists.

Noah Smith is overall a big fan of How Asia Works , but took this review as an opportunity to write about What Studwell Gets Wrong. His first point:

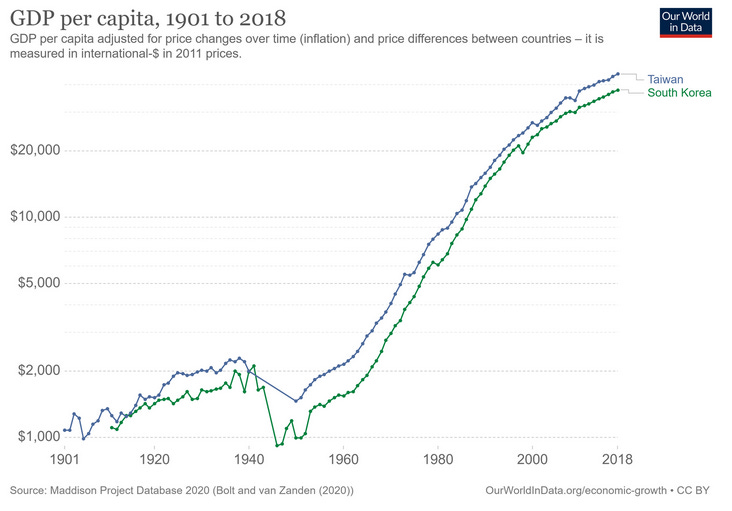

Studwell views South Korea as the development success par excellence. Though he holds up Taiwan’s land reform program (the “land to the tiller” policy) as the world’s best, he believes that Korea executed export discipline more effectively. This, he argues, is why South Korea sits ahead of Taiwan in the per capita GDP rankings.

But those rankings are calculated at market exchange rates. When you instead adjust for purchasing power parity, it turns out that Taiwan is about $6700 richer than South Korea in per capita terms, and that this disparity has existed for quite some time:

I don’t know enough about PPP to have an opinion on this. What I find most interesting is that Taiwan was about 10% richer than South Korea in 1920, and in the past century, as both economies have grown by 3000%, the entire time Taiwan has stayed about 10% richer than South Korea (except maybe a blip around 1942,

Noah then mentions the same thing some commenters did - that southern Asian economies seem to be doing better since How Asia Works got published - and asks:

What should we conclude if this continues for another decade or two? We might look at the particulars of Southeast Asian industrial policy, and how it changed since earlier times, and ascribe its success to those changes.

…Or, we might start to wonder if successful development policies simply determine countries’ place in a queue. My longtime readers will also know that in addition to How Asia Works , I love Krugman, Fujita, and Venables’ The Spatial Economy. And in the final section of that (highly technical) book, the authors turn what was a humble theory of urbanization into a grand theory of global development. And the upshot of that grand theory is that countries have to basically wait in line to get rich. There’s just no way for them to all hop on the rapid industrialization train all at once. Better policy can let you cut to the front of the line, but then the countries you cut in front of are out of luck.

To be sure, this is a highly stylized, pretty speculative theory, which is even harder to prove than Studwell’s. But it kinda-sorta fits the observed pattern in Asia — first Japan and Hong Kong and Singapore grew quickly, then Taiwan and South Korea, then China, now Vietnam and Indonesia. Malaysia and Thailand got a head start on China but then slowed down after the financial crisis of ‘97, while China accelerated — perhaps because China “cut in line” in front of the Southeast Asian tigers. But now, with China slowing down, perhaps Malaysia is back at the front of the line.

Anyway, this would be a depressing, fatalistic sort of world, where development is a zero-sum-game in the short term. Hopefully it’s not true — I’d much rather believe in a Studwellian world where the right smart growth policies can boost lots of countries at once. But we may never know which is right.

This is something I’ve wondered about before, in an even more disturbing way. How much of US wage stagnation has been that we “exported” our potential wage growth to China (or other developing countries)? Relocating a lot of US factories to China is surely good for Chinese factory workers and bad for US factory workers. Then once China becomes less attractive, those same factories relocate to Vietnam or Ethiopia or somewhere.

In a sense, this would be good - it means that everywhere in the world will get rich eventually, free markets are doing their job, and US wage stagnation is (in some sense) nothing to worry about. It would be bad if - well, if people learned it was true and then everyone started demanding tariffs to keep all their country’s wage growth for themselves.

But this is extremely unsupported speculation off of Noah’s already pretty unsupported speculation, and probably some economist will show up to tell me why it’s definitely not true.

Salemicus asks:

But what about the Middle Eastern countries who tried very similar policies in the 60s and 70s, and it didn’t help them at all?

You can’t just pick successful countries who all have X in common and write a Just-So story about how X is the cause. You have to look at all countries with X.

You can find more about the specific Middle Eastern countries and what they did on the thread and in the resources recommended there.

One possible defense of Studwell’s “cherry picking” is that, as per Wikipedia, “Since 1960, only 15 economies have escaped the middle income trap, including Hong Kong, Taiwan, Singapore, South Korea and Japan”. So Studwell is picking a pretty decent fraction of the limited number of cherries that exist.

I tried tracking down the original source, and I think it’s this paper, although it lists only 13 countries: Equatorial Guinea, Greece, Hong Kong, Ireland, Israel, Japan, Mauritius, Portugal, Puerto Rico, South Korea, Singapore, Spain, Taiwan.

Equatorial Guinea struck oil. Puerto Rico is not a country. Ireland, Portugal, Spain, and Greece are European countries that missed the general First Worldification of Europe for various reasons which then went away. Israel is chosen by God. That leaves just the East Asian countries and Mauritius (which sounds fascinating, and which I should try to learn more about).

| [](https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F70683533-f57c-4a68-bb09-b3588842146d_1193x1000.jpeg)The one thing I know about Mauritius. I guess a rising tide does not lift all boats. |

Pseudoerasmus @pseudoerasmus@slatestarcodex Since you asked: re Studwell (1) I’m sceptical of the land reform claims; (2) the IP argument is basically right but IMO the ‘big push’ coordination effect was more important than specific sectoral policies & (3) Malaysia was derailed by the Asian Financial Crisis

Pseudoerasmus @pseudoerasmus@slatestarcodex Since you asked: re Studwell (1) I’m sceptical of the land reform claims; (2) the IP argument is basically right but IMO the ‘big push’ coordination effect was more important than specific sectoral policies & (3) Malaysia was derailed by the Asian Financial Crisis