Mantic Monday 10/17/22

Midterm Examination

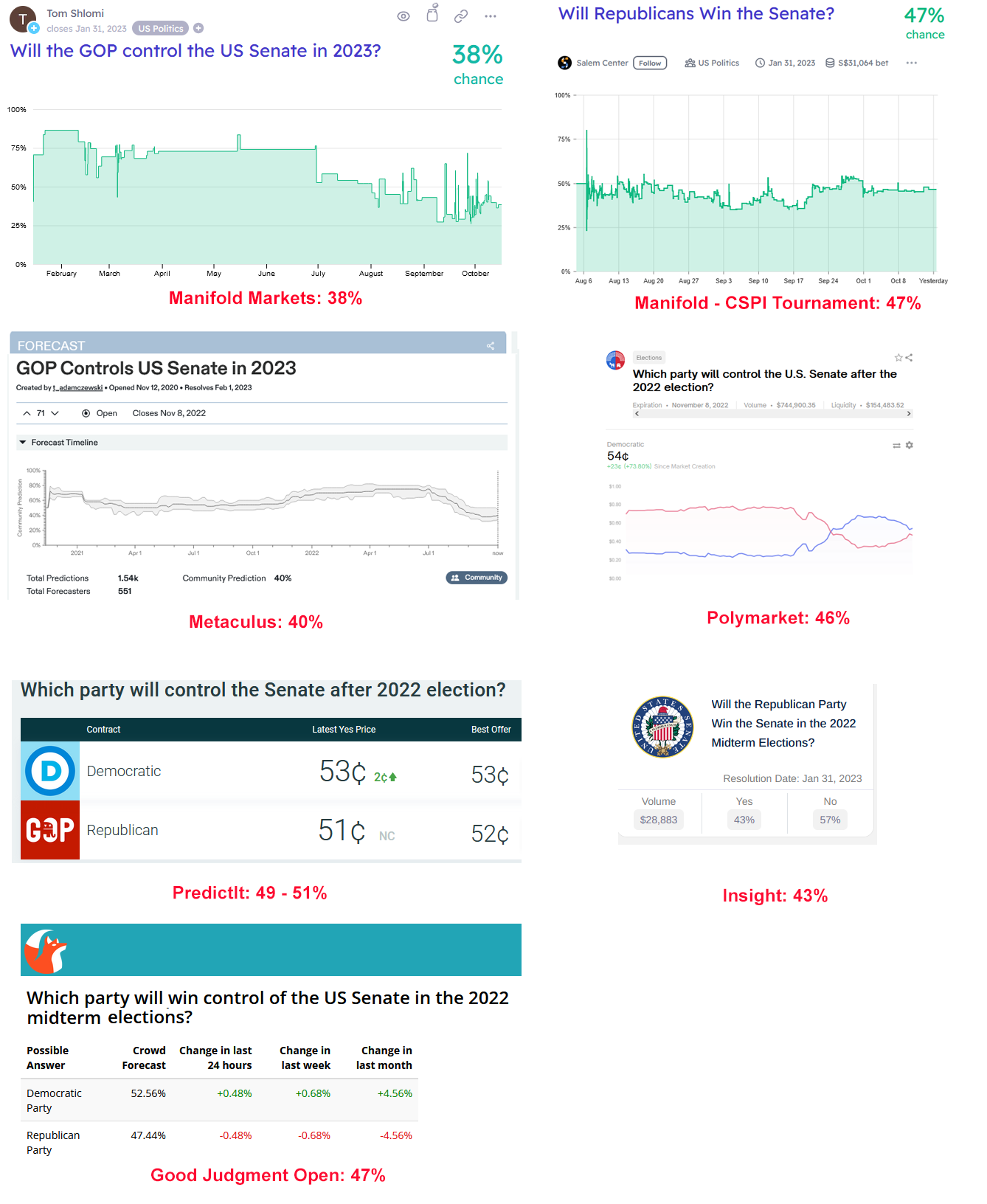

Polls this year look bad for Senate Republicans. Pollsters’ simulations give them a 22% chance (Economist), 34% chance (538), or 37% chance (RaceToTheWH) of taking power. Even Mitch McConnell has admitted he has only “a 50-50 proposition” of winning.

But polls did pretty badly last election. ”Least accurate in 40 years”, said Politico. On average they overestimated Biden’s support by four points, maybe because Republicans distrust pollsters and refuse to answer their questions. Might the same thing be happening this year? If so, does it give Republicans reason for optimism?

Prediction markets say . . . kind of!

Sources: Manifold, CSPI, Metaculus, Polymarket, PredictIt, Insight, GJOpen

Sources: Manifold, CSPI, Metaculus, Polymarket, PredictIt, Insight, GJOpen

The lowest forecaster is higher than the highest pollster! Taking 538 as an example, forecasters range from 5 pp higher (Manifold) to 17 pp higher (PredictIt). Tournaments and real-money markets tend to give higher numbers than play-money sites. I would go with 47% on this one, based on the convergence between GJO, CSPI, and Polymarket.

CFTC vs. PredictIt (and everyone else), Part II

The Commodity Futures Trading Commission is the US agency regulating prediction markets. In August, they told PredictIt (the biggest political prediction market) to shut down, effective in February.

Now a motley group of stakeholders are suing the CFTC for a stay of execution. Plaintiffs include:

-

2 professors using the site as “a source of data for research”

-

2 PredictIt power users with lots of money on various contracts

-

Aristotle Inc, the company that gets paid to operate PredictIt

-

PredictIt, the entity

-

Richard Hanania, for some reason

-

Several additional plaintiffs I can’t find good information about

You can find the complaint here. The plaintiffs write:

The [CFTC’s action], without explanation or other indication of reasoned decisionmaking, without “written notice of the facts or conduct which may warrant” the Revocation, and without providing anyone “an opportunity to demonstrate or achieve compliance” with the terms of No-Action Relief or other requirements, violates the Administrative Procedure Act. 5 U.S.C. §§ 558, 706. Among other things, the Revocation is “arbitrary, capricious, an abuse of discretion, [and/or] otherwise not in accordance with law” and occurred “without observance of procedure required by law.”

The Court should “hold unlawful and set aside” the Revocation, including its

command that contracts that would otherwise turn on events occurring after February 2023 be prematurely liquidated. 5 U.S.C. § 706. The Court also should enter a preliminary and then permanent injunction against the prescriptions in the Revocation requiring the liquidation of contracts by February 2023, including contracts that concern the 2024 elections, well before they would ordinarily mature.

I am not a lawyer, but it sounds kind of like they’re saying “the decision was bad, and the Administrative Procedure Act says regulators shouldn’t do bad things”. I am split between the part of me which hates government regulators doing bad things, and the part of me which feels like this is how you get a cover-your-ass-ocracy that never does anything at all without fifteen layers of paperwork and ten trillion dollars per action. Whatever. At least this time it’s in my favor.

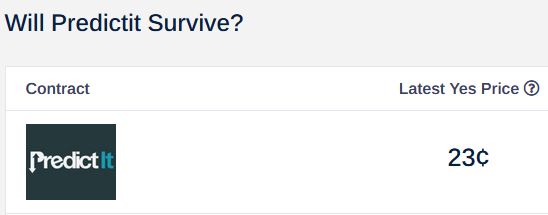

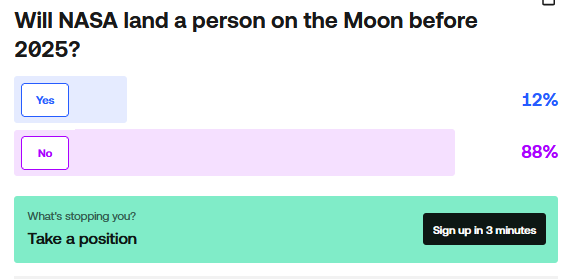

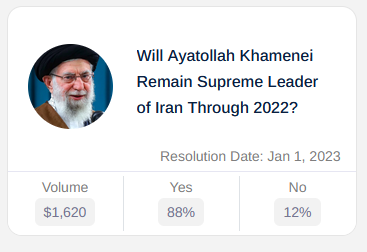

Of course there are prediction markets about it:

Source: Insight Prediction

Source: Insight Prediction

Nuclear Warcasting, Part 2

Samotsvety Forecasting is a team made of top prediction market players and tournament winners, vaguely affiliated with effective altruism, who make predictions in the public interest. Earlier this year, they got attention for forecasting the risk of nuclear war - in particular, they said there was an a 0.01% per month chance of London getting nuked this spring.

Since then, most of the fear has crystallized into a specific scenario. Suppose Russia is losing very badly in Ukraine. Putin, fearing a coup or revolution at home if he gives up, decides to use a tactical nuclear weapon, ie a “small” nuke more suited to winning battles than destroying cities. He nukes a Ukrainian battlefield position. The West is enraged at this violation of the nuclear taboo and feels like it needs to respond decisively - maybe by nuking something on Russia’s side, or through some other act of extreme escalation. Then Russia feels like they need to respond, and eventually it escalates to strikes on major cities and global nuclear war.

There are reasons for doubt. Tactical nukes wouldn’t really be useful in Ukraine; the battle lines are too spread out and there’s no single place where a nuclear explosion could take out a substantial portion of Ukraine’s forces. In the past, nuclear powers have accepted lost wars gracefully rather than turning to nukes. And the Russians deny it, and saying this is all just Western propaganda intended to scare people.

Amid this uncertainty, Samotsvety has published an update: now they are at 16% chance that “Russia uses any type of nuclear weapon in Ukraine in the next year”, and 0.02% per month of a strike on London.

Although they didn’t mention it this time, they previously said the risk of a strike on San Francisco was a little over half that of London; I don’t know if that’s changed.

See also Dan Keys’ comment here for some skepticism of Samotsvety’s process.

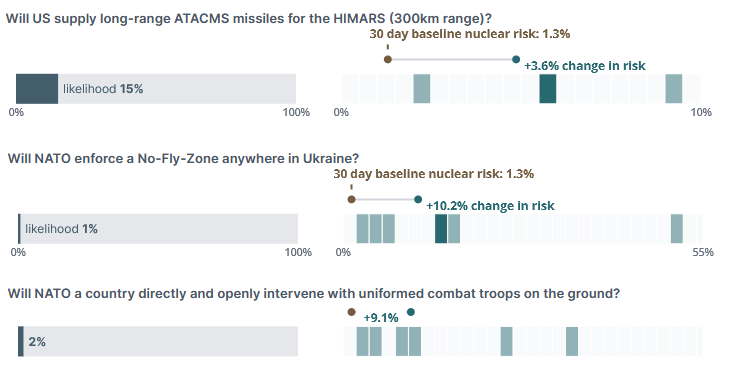

Swift Centre is a lot like Samotsvety; they’re a collection of top forecasters brought together by EA to make important predictions. They also took a swing at the nuclear question, and said 9.1% chance of a hostile nuclear detonation in Europe in the next six months. They didn’t calculate the risk that this would spread to global war, but they did discuss how different scenarios would bring the risk up or down:

One of my hopes for forecasting is that it eventually becomes so well-validated that decision-makers can take these kinds of considerations into account: “Should we sent ATACMS missiles to Ukraine? It would have such-and-such benefits, but also increase the risk of nuclear escalation by 3.6%, is it worth it?”

We can’t directly compare Samotsvety and Swift because they’re predicting over different time periods. But assuming that there’s more risk in the next six months than in the six months after that, I think Samotsvety is a little higher but they’re not embarrassingly far off.

Metaculus is a bit more optimistic than either, believing there’s only a 4% chance of detonation in Ukraine in 2023 and a 7% chance of any use in the next ~year. Max Tegmark is going much higher than anyone else and says 16% chance of global nuclear war.

Kalshi Applies For Election Markets

Kalshi is a regulated and fully-legal prediction market with good lobbyists and a compliance team. This means the CFTC probably won’t randomly shut them down one day. But it also means they can only create new markets with CFTC permission.

In July, Kalshi asked the CFTC for permission to make midterm election prediction markets - specifically, which party will win control of the House and Senate. The CFTC has said they will make a decision by October 28 (which doesn’t leave much time for predicting to happen before the November 8 election, but I guess it sets a precedent).

September was the Request For Comment period, when the CFTC solicited comments from stakeholders about what they should do. Kalshi tried really hard to get lots of people to send in positive assessments - I know this because of how many people asked me “why is the CEO of Kalshi emailing me about this thing?” Their strategy seems to have worked; among the people who wrote to the CFTC in support were:

-

Matt Bruenig, left-wing commentator

-

Zvi Mowshowitz, rationalist/blogger

-

An “art dealer . . . lifelong philanthropist and activist focusing on promoting women’s and LBTQ+ rights…on the board of a nonprofit organization founded by Hillary Clinton”

-

The Manifold Markets team, along with Nuno Sempere, Linch Zhang, Ozzie Gooen, and other rationalist/EA forecasters.

-

Jason Crawford from Roots of Progress

-

Sam Altman, OpenAI and Y Combinator

-

Alex Tabarrok, GMU and Marginal Revolution

-

Robin Hanson, prediction markets pioneer

-

Dustin Moskovitz, Facebook co-founder and effective altruist

-

A former chief innovation officer at the CFTC’s labs who now runs a company called “Gattaca Horizons”, this is not ominous at all

-

A group of very famous academics, including Phillip Tetlock, Robert Shiller, Justin Wolfers, Scott Sumner, etc

-

The owner of the Sacramento Kings, for some reason

I personally declined to comment because I was still angry at Kalshi for (suspectedly!) having a role in the PredictIt decision. Now I feel kind of childish for this, because many other equally angry people swallowed their pride and agreed to send the positive comments for the good of forecasting in general - including the CEO of the company that runs PredictIt! Others including Moskovitz wrote pro-Kalshi comment but recommended that CFTC also approve other markets. Whatever, too late to change things now. I may also have sent a kind of petty email insulting the Kalshi people when they asked, which I feel slightly bad about. Oh well. As the Dalai Lama says, “don’t be petty and vengeful, but if you are, at least blog about it publicly to maximize its future deterrent effect.”

I couldn’t find too many comments in opposition, but one came from a group called Better Markets, which wrote a very long argument saying this was too close to gambling and was a further step towards “the deeply troubling trend toward the

’gamification’ and ‘retailization’ of finance.” Also, frequent prediction market player Avraham Eisenberg wrote a not very serious comment which may have been motivated by spite toward Kalshi, or him just not being a very serious person.

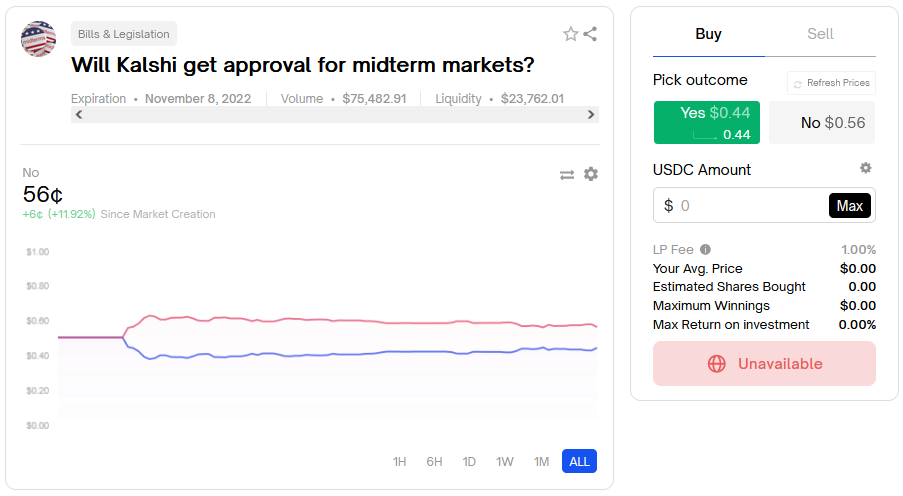

Of course there are prediction markets about it:

Source: Polymarket

Source: Polymarket

…but they disagree pretty heavily. Given that Polymarket has $75,000 of real money and Manifold has $3,000 of fake money, I’m trusting Polymarket here.

Extremely related: Aristotle, the company that runs PredictIt, has also applied to the CFTC to operate election markets. They’re using the name Aristotle Exchange, so I don’t know if this is for PredictIt or some potential future project. They seem pretty serious about this and a very under-invested-in market on Manifold gives them a 53% chance of success by next year.

Dustin Moskovitz’s comment on Kalshi very weakly suggests that Polymarket might be interested in this as well, although I haven’t heard anything more substantial about this.

Manifast

First of all, thanks to the Substack team for making Manifold Markets embed easily in Substack! Taking advantage of their hard work:

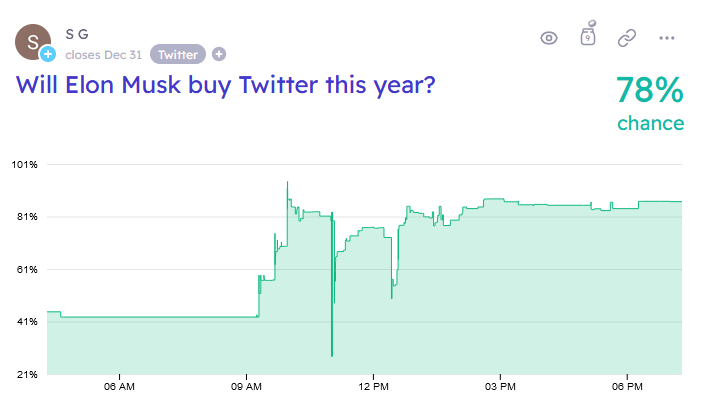

Okay, 78% chance, but here’s what I find interesting:

Compare this to Twitter’s stock price (source: Yahoo Finance)

The stock price started rising at about 11:50 (I assume this is EDT); the first article I can find on the switch was Bloomberg published at 12:08.

My Manifold is set to Pacific Time, so offset by three hours. It looks like the first people started trading on the news around 12:20, and the change had been fully priced in by 12:50. So Manifolders started trading on the news about 30 minutes after the stock market and 12 minutes after the media picked it up, and had fully priced it in within half an hour.

This is really encouraging! I had previously worried that play money wasn’t enough of an incentive to obsessively price in breaking news, but at least on this one big question it is.

This Week In Markets

Apparently inspired by Dominic Cummings predicting 50-50. Polymarket is even more bearish.

I’m really surprised by this - I thought I remembered hearing this was implausible and many years away. It looks like some of the probability comes from a group called Upside Foods which might get approved next year, but their website seems designed to avoid giving readers any relevant information whatsoever.

From the description:

“The Eiffel Tower is in France” seems (in my personal judgment) like the sort of fact that early AI pioneers could and did represent within GOFAI systems. GPT-J probably does more with that fact - it can for example answer how to get to the Eiffel Tower from Berlin, believing that the Eiffel Tower is in Rome. But the paper didn’t offer neural transparency into how GPT-J gives directions, we don’t know the stored patterns for answering that part - just a neural representation of the brute idea that GOFAI pioneers might’ve represented with in(Eiffel-Tower, Rome).

This market reflects the probability that, in the personal judgment of Eliezer Yudkowsky, anyone will have uncovered any sort of data, pattern, cognitive representation, within a text transformer / large language model (LLM), whose semantic pattern and nature wasn’t familiar to AI and cognitive science in 2006 (to pick an arbitrary threshold for “before the rise of deep learning”).

This is one of the kind of “predict the course of AI development” applications people were excited about using prediction markets for, so I’m happy to see a pretty liquid market trying it. See the Technical AI Timelines group for many others.

There are also markets for the same question re: 2022 (16%) and 2024 (34%)

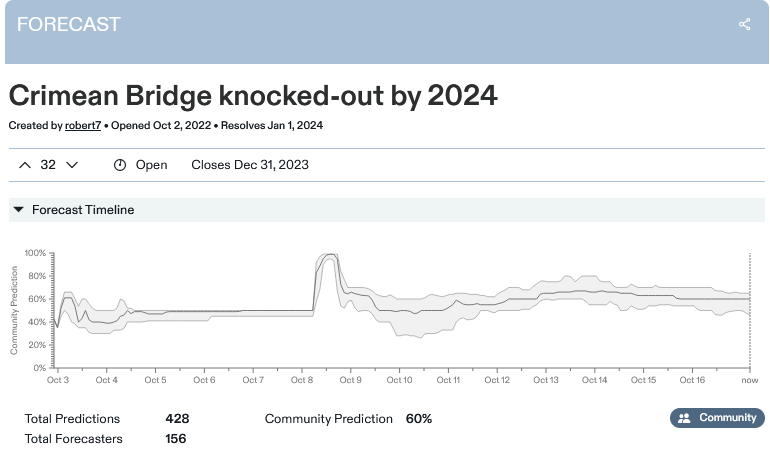

Source: Metaculus. Although the recent blast took out a few lanes, others are still open, so the market hasn’t resolved yet.

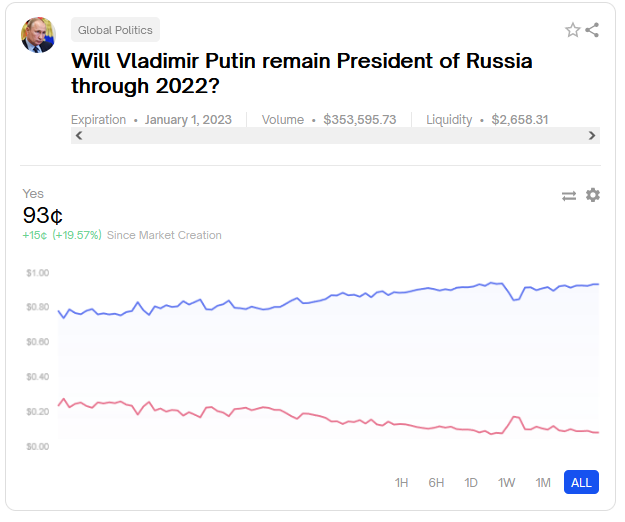

Source: Polymarket. The timeline doesn’t seem to be displaying, but the little spike in NO was on September 12 - I’m not sure what happened then. No obvious change for the mobilization on September 21. The overall story here is just Putin’s chances getting better as the year comes closer to ending without him being deposed. Manifold broadly agrees.

Source: Kalshi

Source: Kalshi

Source: Insight, but note low volume

Short Links

1: Less Wrong’s Petrov Day celebration caused prediction-market-related drama.

2: Kalshi now on Bloomberg terminal:

193Likes18Retweets](https://twitter.com/mansourtarek_/status/1577323820607758337)

3: Avraham Eisenberg is a frequent prediction market player whose insights and stories been featured here several times. He recently achieved every trader’s dream - perpetrating a financial scheme convoluted enough to make it into Matt Levine’s newsletter (he also made $114 million). Unclear at this point whether it was a crime, Karlstack gives more details, including some detective work connecting it to Eisenberg, here’s Eisenberg’s own statement where he says he’ll return some of the money. I’m mentioning this because I’ve talked about using prediction-market-winning as a proxy for other kinds of skill and intelligence, and I guess executing a $114 million crypto heist is a kind of skill/intelligence.

4: Dynomight on the dangers of conditional prediction markets.

5:Nuno Sempere newsletter September.

6: Most new prediction markets are scams, doomed, or weird crypto cruft, and I promote them out of this category only after a long history of success - but for the record, here are the new ones I’ve heard about recently: Mojito, Zeitgeist, Seer

Tarek Mansour @mansourtarek_Kalshi forecasts have found a new home: the Bloomberg Terminal. Accurate forecasting is imperative to alpha. This partnership with Bloomberg allows traders to use our CPI and Fed forecasts when formulating their trading strategies. More on this Bloomberg x Kalshi partnership:

Tarek Mansour @mansourtarek_Kalshi forecasts have found a new home: the Bloomberg Terminal. Accurate forecasting is imperative to alpha. This partnership with Bloomberg allows traders to use our CPI and Fed forecasts when formulating their trading strategies. More on this Bloomberg x Kalshi partnership: