Mantic Monday 7/26

This Week In Markets

PredictIt remains easy to use, high-volume, and focused almost entirely on horse-race political questions. At least we might get rid of Cuomo.

Polymarket remains a fun alternative way to learn about the news. I only heard about the monkeypox issue a few days ago, and hearing “22% chance of it spreading” is both faster and more useful than some article that dithers for a few paragraphs and finally concludes that “health officials warn Americans not to panic”. I would count it a minor victory if one day news sources routinely included this in their articles, eg “Polymarket, a major prediction engine, estimates a 22% chance that at least one other person will catch the disease.”

Extra credit for the last market, which seems to be successfully predicting a scalar instead of a binary outcome - I’ve seen Metaculus experiment with this technology, but this is the first time I’ve spotted it at Polymarket using real money.

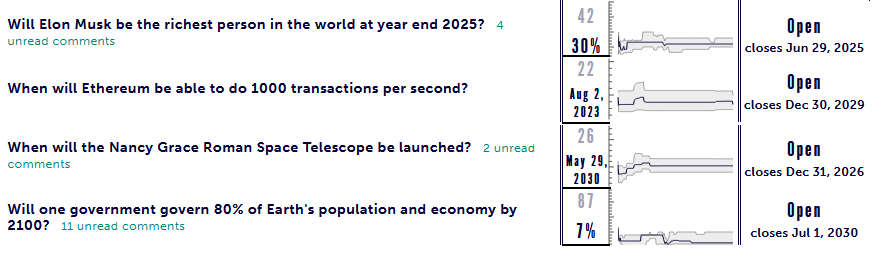

Some of the more interesting new Metaculus markets. The space telescope one is especially interesting in the context of whether we could use prediction markets to predict (and maybe manage) government delays and cost overruns. The telescope is currently scheduled for launch in October 2025, so the market expects it to be about five years late. For context, the previous space telescope, James Webb, was originally scheduled for 2007 and (if everything goes well) will launch later this year.

God Help Us, Let’s Try Predicting The Coronavirus Some More

Anxiety is growing about the new Delta variant of coronavirus. What do the prediction markets say?

Here’s Polymarket:

And here’s Metaculus:

For context, right now there are about 50K US cases/day, and during the worst-ever week there were about 250K cases/day. Forecasters seem pretty sure we’ll get back above 100,000, also pretty sure we’ll get back above 200,000, and give it less than 50-50 odds we’ll set a new record. I don’t think the big gap between 200K and 250K really makes sense, and it’s probably a function of those predictions being on different markets. Still, median of 200-250K seems about right.

The question I found most helpful was the one about EA Global London. You don’t have to know anything about this except that it’s a big conference scheduled for October 29 of this year. It looks like forecasters think there’s only a 40% chance it will be cancelled, which means they expect Britain (and presumably US and EU?) to pass on the option of another wave of lockdowns.

The market predicts that 2022 - 2025 will average 60K COVID deaths/year, with a distribution looking like this:

…which actually is more precise than I expected, with half the probability mass between about 20K and 150K. For comparison, there were about 350K US COVID deaths in 2020, and another 250K in 2021 so far. There are officially 36K US flu deaths in an average year, though some people think this is an overestimate.

So the overall scenario I’m getting from this is that coronavirus remains quite serious for the rest of this year and this winter, probably slightly less bad than last winter, but governments don’t choose to institute very strict lockdowns. Once everyone has been vaccinated or infected, it settles down into something about twice as bad as the flu.

What extra markets would be helpful?

I would love to see something like “percent of Americans who die of COVID between now and 1/1/22 who were fully vaccinated” or “number of fully vaccinated Americans who die of COVID between now and 1/1/22”. I’m not sure how to set this up - I suspect we’ll have credible numbers for this, but maybe not a single source of truth that can be picked out beforehand. Still, it seems important. I think for the percent question I would guess something like 2.5% for this - right now it’s 1%, but vaccinated as share of population will increase, and Delta seems a little better at breaking through vaccinations than Classic. But this is very low confidence and I would like to know what the mob thinks.

Something about the developing world, but I don’t know how I would phrase it, given how poor reporting there is likely to be. Still, the market could either ask about India / South Africa / etc (accepting that there will be underreporting and asking traders to price it in) or about serology studies (accepting that we can’t name a specific serology study ahead of time and the resolution committee would have to be given some leeway to say which ones they trust).

New Kid On The Block

Kalshi - the first fully-regulated real-money prediction market - is now open for public beta.

The signup process wasn’t so bad. Upload your ID, check a box saying you read some long contracts which you realistically did not read, then link your bank account or wire them the money. It took me ten minutes, aside from the inescapable wire transfer delay.

Here’s what they’ve got:

Nothing here looks too bizarre, maybe because there are as yet no contracts about D**d T*p.

So far the volume is a lot less than on PredictIt or Polymarket, but it’s a new public beta, what did you expect?

The most exciting part is the monetary limit, which seems to be $25,000 per market (on buys, not earnings - so in theory you could buy $25,000 one-cent shares and win $2.5 million if you’re right). That’s about 30x the $850 limit on PredictIt. “Kalshi trader” could very easily be someone’s day job - though it’s probably still not worth opening your own investment bank over.

The least exciting part is the fees. They’re a bit complicated, but most of the time they’re around 10%, win or lose. I appreciate that this company is doing a really hard thing and deserves to make money, but I just don’t know how to square that with the fact that fees make prediction markets a lot less useful. Tetlock says that superforecasters are able to wring genuine signal out of single-digit differences in probability - when a superforecaster says 63%, they really mean 63%, and their prediction becomes less accurate if you round it to 60% or 65%. I don’t know how you’d match that in a market with 10% fees - and it looks like Kalshi traders don’t either, given that there’s currently a 103% chance that New York either will or won’t close indoor dining.

(update: a representative of Kalshi tells me that only people who take offers pay the fee, so on average if you’re making half the time and taking half the time, fees will average out to about 3.5%.)

Dependency Ratios

Here’s a neat set of Metaculus questions:

Dependency ratio is the ratio of non-working age people (eg elders, children) to working-age adults. Higher numbers mean more dependent people and greater economic burden. Right now it’s 50 across most of the world, except in Africa where it’s 80 (Africa has lots of kids!). Metaculus predicts that in 2039, it will have gone up a bit in the US and China, and a lot in Germany. Presumably the US escapes Germany’s fate through immigration. I don’t know why they’re so optimistic about China, but this matches more centralized projections, so probably they are right and I am wrong, maybe because they are starting from a very young base.

Also, the Israel question. Haredi are ultra-Orthodox Jews known for having traditional (ie very large) families. Right now they are 9-12% of the Israeli population. If they keep having 5-10 kid families, and everyone else in Israel just has normal-modern-sized families, what will happen? According to Metaculus, they’ll double to 24% of the population in 2050. Makes sense, though weird to think about.

Metaculus Is Hiring

From their website:

We’ve been working steadily and quietly on an initiative that will create new ways for our community’s forecasts to engage with and inform policy and institutional decision-making, and educate and attract budding forecasting fans. For the next year, Metaculus will publish a series of experimental “fortified essays” on critical topics – emerging science and technology, global health, biosecurity, economics and econometrics, technology policy, global risk, environmental science, and geopolitics. These are longform, educational essays fortified with testable predictions.

To support this project, we are hiring 3-5 Analytical Storytellers – researchers, rationality enthusiasts, data scientists, and quantitative analysts – to write about their areas of expertise with creativity, clarity, and embedded forecasts. These pieces will be fortified essays, a flexible format that can incorporate interactive Metaculus forecasts, serve as a primer on crucial topics, showcase original analysis, and spotlight and contextualize high-leverage questions.

Analytical Storytellers will be able to pitch the tone and content of their essays to a smart but not stuffy audience. Essays will connect with readers who possess the relevant subject-matter expertise, while also appealing to a layperson who is open-minded, but may not yet understand what’s so fascinating about Kessler syndrome or photonic tensor cores. After reading, however, they will.

They will leave the fortified essay appreciating the current state of knowledge on the topic, and will be able to track some of the most important open forecast questions that are likely to shape the topic in the future. They’ll better know the stakes involved, what hinges on the resolutions of those open forecast questions, and they’ll be prepared to fit the next piece of information they encounter into a larger matrix of meaning.

We want to quickly fill 3-5 such roles. We hope you’ll apply, or share this job posting with someone you think is a good fit!

Compensation will be “commensurate with experience” because “given the novel and experimental nature of the fortified essays we’re asking Analytical Storytellers to produce…we will have uncertainty about candidates’ level of experience, work quality, and the amount of time that it takes them to produce high-quality output.”

If only there was some good method for estimating things you are temporarily uncertain about! Anyway, read more and/or apply here.