Mantic Monday: Dogs In Wizard Hats

I found this YouTube explainer about prediction markets on the subreddit. It’s pretty good! My small nitpicks are that it overestimates their accuracy relative to traditional forecasters (it focuses on markets beating forecasters in 2008, but I don’t think this is consistent) and underestimates their resilience against bad actors trying to skew the probabilities. Still, this will be my go-to source when someone wants a short explanation of what these are and why I’m so excited.

Futuur Soon

Last week I mentioned a new prediction market called Futuur . Today we’ll look at it in more depth.

Futuur sends non-Americans to their real money markets and Americans to their play money markets (because of the US’ unique anti-prediction-market regulations).

Their play money markets are awful:

(source)

(source)

Wrong: a Mars landing by 2024 isn’t 17% likely. This kind of mistake is an inevitable consequence of their play money model, which gives every user 10,000 units (“Ooms”) when they first join. First of all, most people don’t care about Ooms and won’t participate. But second, if you go all in on correcting this mispricing, you’ll lock all 10,000 of your Ooms for three years to earn a 17% return. That’s super boring. You’ll join this site, make one bet, not be able to do anything else for three years, and even after you win you won’t be close to making the leaderboard or being an Oom tycoon. So what’s the point? Not much, which is probably why nobody has corrected this (including me, who considered it and then decided it sounded annoying).

But here’s where it gets weird: their real money markets aren’t much better!

(source)

(source)

They give their resolution source as this California government website, which says there have been fewer fires this year, 8800 vs. 9600. It’s been updated pretty recently, and this isn’t California’s fire season, so there’s no way there will be another 800 fires in the next four days. As far as I can tell, this is free money - though probably after Astral Codex Ten mentions this question, people will notice and correct it pretty quickly.

I think I bite this bullet. This is the newest prediction market in the world, it’s been operating about two weeks, they’ve banned the country most likely to use their product, and they probably use automated market makers that have no idea what they’re doing. I only found this place because I’m trying my hardest to stay on top of breaking prediction market news. Maybe I shouldn’t be surprised if I run into some that are still in the phase where there’s $20 bills on the ground.

I’ve (indirectly) tried betting on this and will report back later. There should probably still be some opportunities left to make 3 to 4 digits worth of free money if you’re interested, non-American, and can use crypto. But keep in mind that there might also be some systemic risk - this is a new market and nobody has had a chance to check if they really pay out!

Mantic Everyday

Mantic Markets has stolen its name from my newsletter! But they’re so interesting that I can’t stay angry.

Here’s a typical market they’re offering:

The perceptive among you might notice that “…and things like that” isn’t usually the sort of thing you see in a forecasting question. Typical questions are obsessively well-specified - not just “Hospitals will be at over 80% capacity”, but “Hospitals will be at over 80% capacity according to the 1-20-22 report by the American Hospital Capacity Association, or if no report comes out on that date, the most appropriate alternative source chosen by our Resolution Committee”.

This is good because it maintains everyone’s faith in the objective process, but bad because what people actually care about is whether there will be something that feels like a crisis situation , which is hard to instrumentalize in hospital numbers. Mantic wants to lean into the subjective side of prediction markets and see what happens.

Their idea is: anyone can write a question on their market. Whoever writes it also judges it. So if I write the question on whether Omicron will cause a hospital overcrowding crisis, I get to decide whether whatever’s going on next month counts as a “crisis” or not. The intended audience is people who know and trust me - in my case, it might be blog readers like you. So you’d be trying to predict whether I will think that our future coronavirus situation looks like a “crisis”. This is obviously somewhat but not perfectly correlated with whether you think it’s a crisis and whether by some objective standard it really is a crisis, but it’s not clear that it’s any worse of a measure than what number the American Hospital Capacity Association puts on a report. Caveat emptor , I guess.

What brings this over the top from “weird idea” to “weird idea that provokes maniacal laughter” is that the person who writes/judges the question gets a percent of the trading volume as a fee. So if I propose and judge this question and people place $10,000 worth of bets on it, I might get $100.

One of the giant bottlenecks for existing prediction markets has been getting people to write questions for them. This is hard for two reasons: first, it’s thankless work, and second, you have to do a lot of nitpicking of resolution criteria - figuring out whether the American Hospital Capacity Association is really trustworthy, how often it puts out reports, etc. This eliminates both reasons - you can resolve questions however you want, and you’re financially incentivized to create and promote them. If this works, expect “COME BET ON MY PREDICTION MARKET QUESTION!” to join penis enlargement pills and crypto Ponzi schemes as a classic form of spam.

Does this incentivize bad actors to secretly bet on their own markets, then resolve them falsely in order to make a killing? Yes, definitely. And it’s crypto, so it’s unclear there’d ever be any way to find these people or get the money back. Smart people will stick to markets created by named people with good reputations; I’m not sure there’s much more to it than that.

So far Mantic is having the same kind of CFTC problems as everyone else - it’s probably illegal to offer real money prediction markets to Americans. They’re still trying to figure out ways around this, so for now they’re a beta version with play money only. I don’t know if they’ll succeed. I’m most interested in their model, which I think has a lot of potential and is an obvious choice for an established competitor to steal.

Conflict of interest notice: they have applied for (and will probably get) an ACX Grant. Other than me giving them money and publicity, and them stealing my favorite prediction market related word, I’m not actually affiliated with them in a meaningful sense.

Metaculus Public Figures

You may remember from last post that there is a lot of stuff at Metaculus.

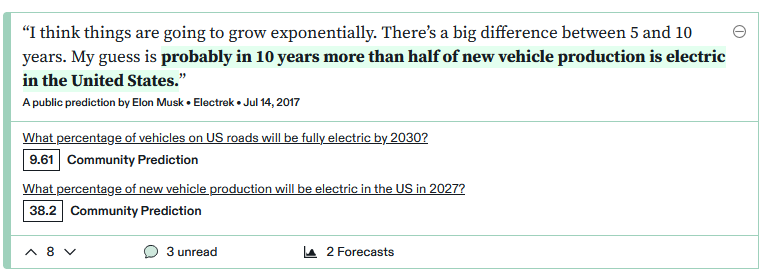

Here’s their Public Figure Predictions page. It tries to collect predictions by important public figures and compare them to the Metaculus consensus for the same question. For example, from the Elon Musk page:

So Musk said that he thought more than half of vehicle production would be electric in ten years, but Metaculus thinks it will only be 38%. This seems much more civilized than the usual thing where you accuse people of being hype-mongers.

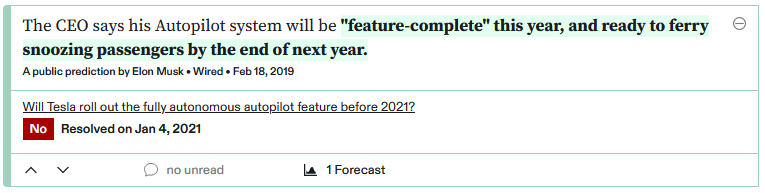

Which is not to say it’s less harsh:

…they’ve been doing this for a while and have a record of how right or wrong everyone was.

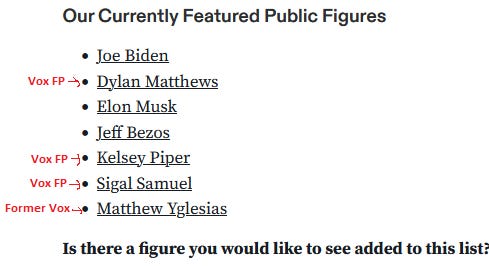

Unfortunately, a lot of their “public figures” right now are Vox Future Perfect journalists, the only famous people who consistently make hard-and-fast predictions and give clear probability estimates.

I’m sure it’s just a matter of time before everyone else figures out this is the wave of the future and joins in!

This Week In The Markets

Well, this is on everyone’s minds now, might as well start with it:

(source)

(source)

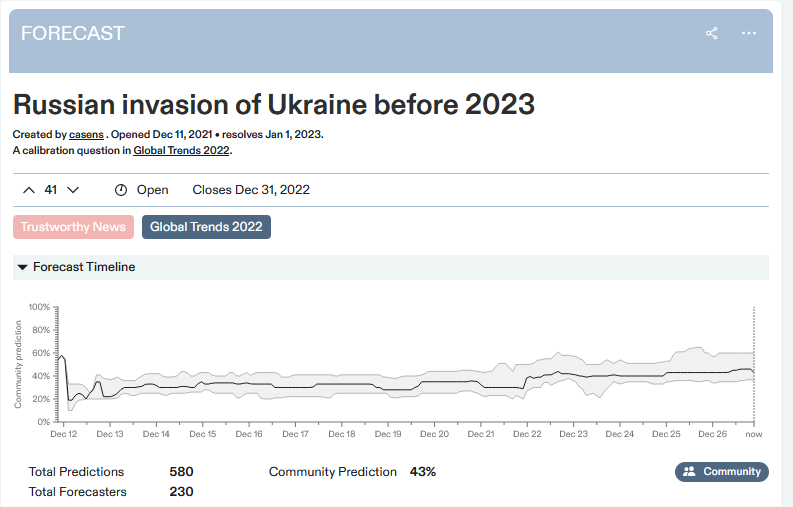

Will Russia invade Ukraine within a year? This is one of those “all depends on the resolution criteria” questions, since Russia already has troops in what most countries would consider Ukrainian territory, and these sorts of tense standoffs involve a lot of limit testing. Metaculus has gone with “either Russia or two other Security Council member countries state that Russia has invaded Ukraine”, which seems fine.

This was hovering at 30% throughout mid-December and has since risen to 43%

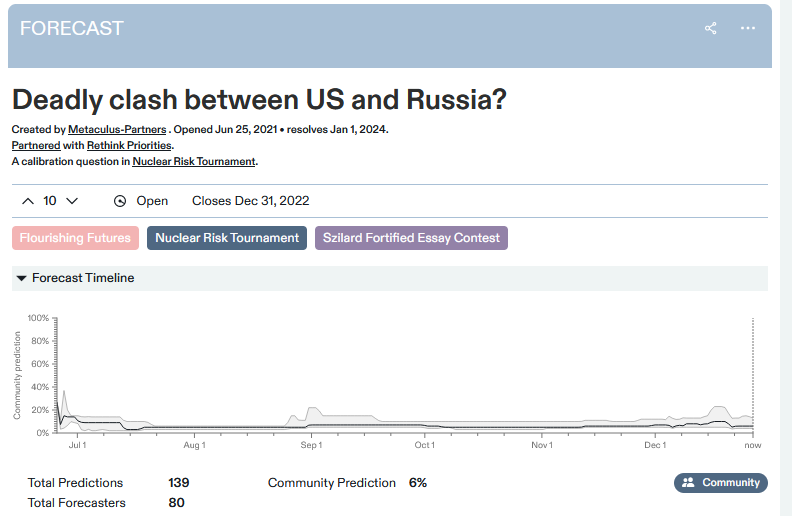

But this hasn’t significantly affected a longer-running “deadly clash between US and Russia by 2024” market:

(source)

(source)

Maybe this means forecasters don’t expect a potential Ukraine-Russia war to involve the US directly?

It has affected a US-Russia war by 2050 market, which rose from about 6% earlier in the year to 16% now. I don’t know why US-Russia war by 2050 has risen so much faster than US-Russia deadly clash by 2024, unless forecasters believe the current instability is laying the groundwork for future problems but they won’t materialize by 2024.

Polymarket, PredictIt, and Kalshi are silent on this question for now.

On a happier note, Metaculus is bullish on the James Webb Space Telescope:

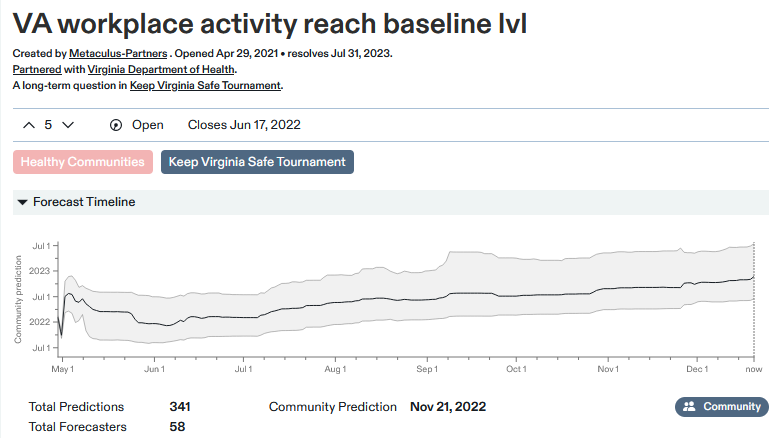

And finally, of all sad tales of mice and men, the saddest is probably this Metaculus question on Virginia workplaces:

The outcome is measured in some kind of Google mobility data, but that’s irrelevant. The question is how long it will take to go back to normal after the coronavirus.

In June 2021, people predicted December 2021.

In August 2021, people predicted May 2022.

In October 2021, people predicted July 2022.

This month, people are predicting October 2022.

It seems like the general rule is that every month, the date when people expect normality to return moves about a month and a half further out.

I don’t think this is people being very foolish and failing to update. I think it’s mostly more and more people shifting their predictions to “it will never go back to normal” over time, probably less because of COVID and more because it looks like the work-remotely future has finally arrived. Maybe it’s not that sad after all!

Shorts

1: A “fortified essay” on foot voting coordination efforts, eg the Free State Project. “I believe that there’s a 60% chance that the question, ‘Will a coordinated foot voting effort intentionally move 10,000+ residents to a single American state by 2030?’ will resolve positively.”

2: Balaji Srinivasan suggests using prediction markets to judge the winner of college debates:

Balaji Srinivasan @balajis@pairagraph You might run formal debates. Have people sign in with ENS for proof of identity. And try a prediction market like @PolymarketHQ to see who won the debate, with Oxford-style scoring.

Balaji Srinivasan @balajis@pairagraph You might run formal debates. Have people sign in with ENS for proof of identity. And try a prediction market like @PolymarketHQ to see who won the debate, with Oxford-style scoring.  intelligencesquaredus.orgWhat Is the Oxford-Style Debate Format?The Oxford-style debate format involves a debate on a predetermined statement – also called a “motion” – from two opposing perspectives. The two sides either argue “for” or “against” the motion within a formalized structure. The Intelligence Squared U.S. debate series favors the Oxford-style format …[7:06 PM ∙ Dec 13, 2021

intelligencesquaredus.orgWhat Is the Oxford-Style Debate Format?The Oxford-style debate format involves a debate on a predetermined statement – also called a “motion” – from two opposing perspectives. The two sides either argue “for” or “against” the motion within a formalized structure. The Intelligence Squared U.S. debate series favors the Oxford-style format …[7:06 PM ∙ Dec 13, 2021

9Likes2Retweets](https://twitter.com/balajis/status/1470470285807984640)

I’m not sure I understand this very well yet but maybe someone else can explain it to me.

3: Congratulations to Google’s new prediction market team for making the front page of Hacker News twice last week! A good demonstration that there’s a lot of interest in this field.