Mantic Monday: Twitter Chaos Edition

Twitter!

This is all going to be so, so obsolete by the time I finish writing it and hit the “send post” button. But here goes:

395 traders on this, so one of Manifold’s biggest markets, probably representative. The small print defines a major outage as one that lasts more than an hour. See here for a good explanation of why some people expect Twitter outages.

Polymarket is within 2% of Manifold. Metaculus here has slightly stricter criteria but broadly agrees.

71 traders, still pretty good, but I find it meaningless without a way to distinguish between “everything collapses, Elon sells it for peanuts to scavengers” vs. “Elon saves Twitter, then hands it over to a minion while he moves on to a company building giant death zeppelins”.

Oh, here we go. 20 traders, they think Musk will stay in charge.

23 traders. Twitter was profitable in 2018 and 2019, then went back to being net negative in 2020 and 2021 (I don’t know why) . I don’t think it’s been very profitable lately, so it would be a feather in Musk’s cap if he accomplished this.

24 traders. Twitter’s mDAU have consistently gone up in the past. DAU is slightly different and I think more likely to include bots.

26 traders. One thing I like about Manifold is that it lets you choose any point along the gradient from “completely objective” (eg Twitter’s reported DAU count) to “completely subjective” (eg whether the person who made the market thinks something is better or worse). This at least uses a poll as its resolution method. But the poll will be in the comments of this market, which means it will mostly be by people who invested in this market, who’ll have strong incentives to manipulate it. Maybe Manifold should add a polling platform to their service?

815 traders, one of the biggest markets of all time. It’s easy to see the jump where Musk unbanned Trump the other day. Trump has said that he doesn’t need to tweet because he prefers his own Truth Social network. This is a good business decision on his part, but hinges on him having enough impulse control to stick to his plan and avoid tweeting. The market thinks there’s a 25% chance he can do it!

Polymarket again within 2% of Manifold.

Only 23 traders here, and they’re a lot less optimistic than the Trump traders.

FTX!

43 traders, seems like probably. I’ve seen a lot of Twitter takes about how rich well-connected people never get in trouble for this kind of thing, but the markets seem less cynical.

251 traders, and by the way amazing job by “mr22” who started this market on October 5. I also appreciate the relatively late end date - there’s another market “. . . by 2024” which is in the 30s, but that’s because people don’t trust the justice system to move quickly, not because they think he’ll be found innocent.

There are a series of markets on sentence length which seem to suggest more than a month but less than a year in jail; this doesn’t really make sense to me and I’m going to nervously ignore them.

Only 8 traders here, so take with a grain of salt, but this is a great example of the creative ways people are using Manifold. The market resolves not to “yes” or “no” but to the percent of FTX US users’ funds that they eventually get back; you make money if you were closer than other traders. Here they seem to think most people will only be getting about 14 cents on the dollar. There’s another market for FTX.US users which is a little higher at 29.

34 traders. I think this is too high; I bet it was some random third-tier insider, just because there are more of them and they’re under less scrutiny.

Moving on to the effects on effective altruism in particular (just assume I have all possible conflicts of interest here):

272 traders, check the detailed resolution criteria. I think the strongest case is something like the one described in this article, about Center for Effective Altruism leaders discussing concerns about Alameda Research in 2018. The article doesn’t give specifics but my guess is they were the same issues Kerry Vaughn describes here (though see the followup comment by an employee who left FTX, casting doubt on Vaughn’s claims). That means the market hinges on whether Vaughn’s allegations fit the resolution criteria that “the unethical behavior must have been related to fraudulent investment strategies that involve spending other people’s money without their permission”. Vaughn describes “poor capital controls, including a lack of distinction between money owned by investors and money owned by Alameda itself”, which sounds like it’s in that direction but could cover a wide variety of badness levels. My guess is everyone will end up agreeing that disgruntled Alameda employees whisper-networked that some things were bad about the company in 2018, some of the rumors got to CEA leaders, the leaders debated whether this was worse than normal for a tech startup, decided it didn’t rise to a level where they needed to publicly freak out, and moved on. Isaac will have to pay attention to the details as they come out and decide whether or not it qualifies.

45 traders. This seems to confirm that the CEA incident is responsible for most of the probability mass above; many fewer people think the FTX Future Fund (ie the charitable branch of FTX responsible for giving out their money) was in on this.

Related: this market only has five traders, but I’m highlighting it anyway in the hopes that it gets more. The most money is on 2022. My guess is that we’ll find that they had terrible accounting practices in 2018-2019 of the sort that could be classified as criminally incompetent in a way that bled into fraud (but the trades went fine so nobody was harmed) and then they ramped it up a lot in 2022 to deal with the crypto crash. I think this market will be harder to resolve than people expect.

47 traders. Everyone is panicking about this possibility, but it looks like it’s not too likely.

10 traders. I’ll take this chance to say: a lot of media is predicting the death of EA, or a major blow to EA, or something in that category. Not going to happen. The media isn’t good at understanding people who do things for reasons other than PR. But most EAs really believe. Like, really believe. If every single other effective altruist in the world were completely discredited, I would just shrug and do effective altruism on my own. If they instituted the death penalty for effective altruism, I would do it under cover of night using ZCash. And I’m nowhere near the most committed effective altruist; honestly I’m probably below average. “Saint gets eaten by lions in Colosseum, can early Christianity possibly survive this setback?” Update your model or prepare to be constantly surprised.

6 traders. So, we lost several hundred million dollars of funding in a giant disaster which was also morally outrageous and demoralizing. It happens. But lots of people have already emailed me asking how to send in more money to help fill the gap. Some added something like “it was so depressing that all the FTX money meant my money didn’t make a difference, but now I can help again, and it’s great!” Can these people fill the hole? 32% chance that they can!

10 traders. And if they don’t, we’ll still probably do better than in 2021, before all the FTX money started rolling in. We’ll try harder to hammer in the point about not doing “ends justify the means” reasoning, and do some reorgs and purges to prevent anything like this from happening again, we’ll make a bunch of other changes - some reasonable, some panic-driven - but we’ll go on. If all the far-future stuff collapses, we’ll donate to global health charities. If the global health charities don’t work, we’ll fund GiveWell to sit around and figure out something that does. If GiveWell gets hit by an asteroid, we’ll work on asteroid deflection (actually I think we might already be doing that). If asteroid deflection turns out to be -EV, we’ll switch to shrimp welfare, or give ourselves Zika virus, or any of a million other things. You have no idea how committed we are to continuing to do effective altruism regardless of whether or not it’s “popular”.

But it will be popular. 45 traders, resolution criteria at the link, notice the dip when the FTX news broke, followed by recovery as people had time to think it over more.

Moving on to slightly less serious topics:

The snapshot doesn’t show this, but one of the suggestions is Atlas Rugged.

67 traders, interesting to see where forecasters’ priorities lie. This was a big rumor early on, along with “everyone was on meth”, but the on site psychiatrist said it was false during an interview.

13 traders. WHY DO PEOPLE KEEP GOING ON PODCASTS?

Midterms!

That was two weeks ago? It feels like years!

A week before the midterms, I wrote:

Polymarket, Manifold, and PredictIt now have shiny interfaces for predicting the upcoming US midterm elections. In terms of the Republicans taking the Senate, Polymarket is at 65%, Manifold at 58%, PredictIt at 73%, and 538 at 49%.

Congratulations 538!

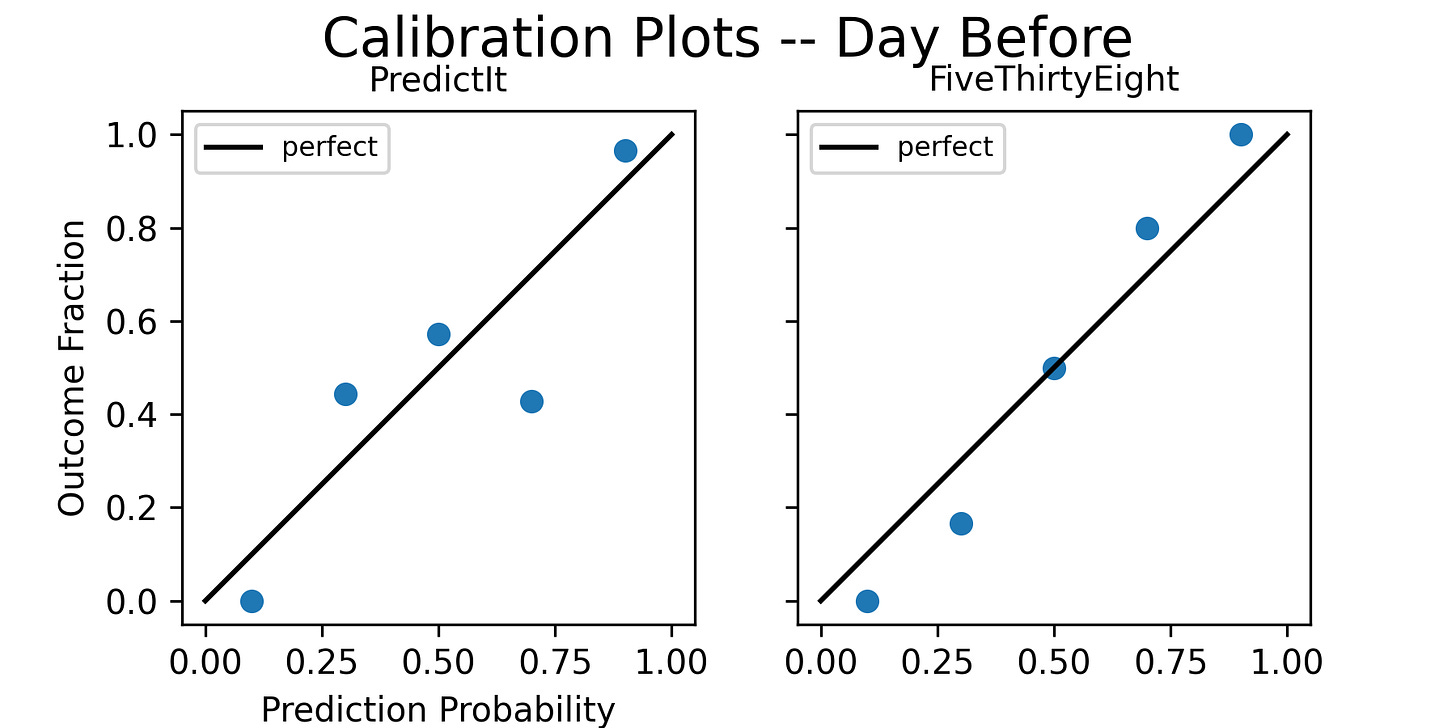

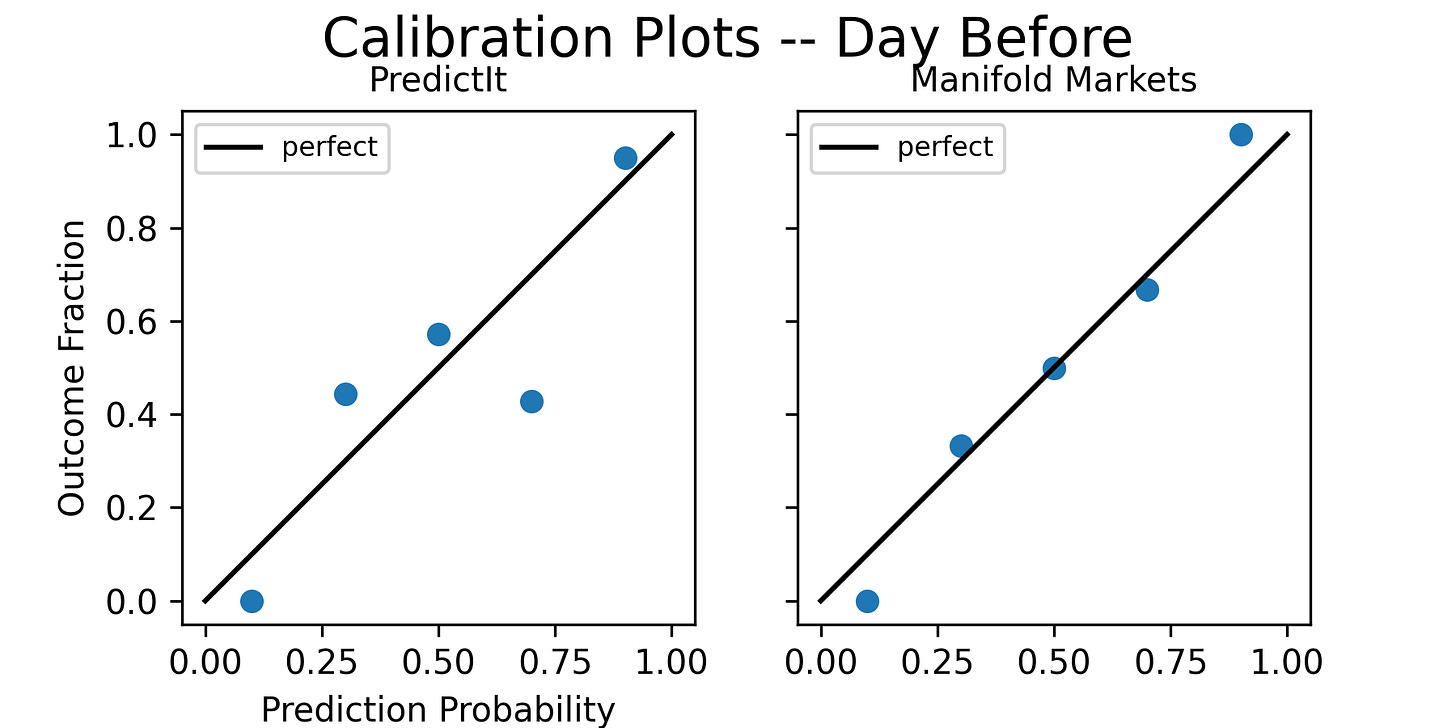

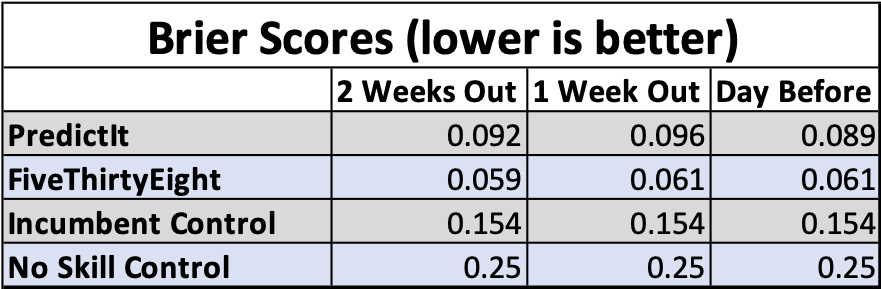

Mike Saint Antoine (who wrote the review of Viral in the last Book Review Contest) has put some more work into scoring midterm election forecasts. Here are some headline results:

Mike writes:

The reason I didn’t just do a three-way comparison between PredictIt, FiveThirtyEight, and Manifold Markets is that the Manifold Markets forecasts included fewer questions than the PredictIt and FiveThirtyEight forecasts. So in order to do a fair comparison here, I’ll be comparing the smaller subset of questions for which PredictIt and Manifold Markets both gave a forecast.

So it looks like both Manifold and 538 did better than PredictIt, and there’s no clear way to tell which of the former did better.

(except I guess you could do this analysis with just the subset of questions Manifold and 538 share, but Mike didn’t and I’m also not going to).

PredictIt has a pretty consistent Republican bias (it’s a minor epistemic sin to accuse a prediction market of having a predictable bias unless you’ve made money exploiting it, I made $600 this election so I’ll let myself pass). In years when Republicans do better than expected, it will probably look better than other markets; in years when they do worse, it will look worse. Still, this is a bias, so I think we should take them doing worse this year as a fair reflection of their accuracy, even thought next year it could go the other way.

My main two takeaways here are:

-

PredictIt isn’t yet good enough that the ideal theorems showing prediction markets should be unbiased and better than everyone else apply to it. The obvious explanation is its $800-per-question cap. Polymarket doesn’t have that cap and it did better, although Mike hasn’t done a formal comparison to 538.

-

Even though Manifold uses fake money and is new, it seems better than PredictIt for now, and the headline results, although very weak and hard to draw conclusions from, suggest as good or better than PredictIt. We can’t formally compare them to Polymarket but the headline results look good.

Also, congratulations to the Democrats, and I guess also to House Republicans.

Scandal Markets

When the FTX news broke, I wrote about Nathan Young’s idea of having scandal markets for various public figures. That is, what’s the chance that they get into a scandal so bad that you regret associating with them? This would be useful partly for people wanting to know who to avoid. But also, after a scandal there’s always associates saying “But how could I possibly have known?” and victims saying “All the red flags were right there!” Scandal markets would solve this; if the market was at 1% before the scandal, the “how could I possibly have known”-ers were right. If it was at 66%, the “red flag”ers were.

Some important people freaked out about this and asked Nathan to take the markets down, which he did, but some other people have put other ones up:

12 traders. I like the “scandal” framing better than the “fraud” framing - I don’t make many specific claims or handle other people’s money, so I don’t know what it would mean for me to commit fraud. I appreciate the extra accountability, though.

But other people are still against. There’s an obvious way to settle this - just make a prediction market on whether it will be + or - EV:

53 traders. Let’s think about the possible failure modes.

Someone might make a false rumor (eg of sexual assault). Traders would trade on the false rumor and the scandal market would go up. This doesn’t exactly seem like a failure mode; this is the prediction market correctly reflecting the current consensus of smart people (which happens to be false). It’s not any worse than the normal thing where people make false rumors and other people believe them, except that there’s an easy way to access the fact that it’s happening. It might even be better - “always believe women” is more compelling as a slogan than as an investment thesis.

Someone might make a false rumor that they wouldn’t have made otherwise, specifically to move a market. That seems like a pretty cartoonish level of evil in order to get fake play money, but there are some real weirdos out there.

The resolution criteria could make things unfair in one direction or another. If it’s “convicted by a court”, very few sexual assault cases ever make it to court, probably that would be a low probability even if the person involved was a known assaulter. But if it’s “so-and-so thinks it happens”, it depends a lot who so-and-so is. There’s even risk of a hyperstitional cascade, where traders believe if the prediction market is high than so-and-so will believe it, so the prediction market ironically produces its own outcome.

What if someone tries to manipulate the market to destroy someone else’s reputation (or to protect their own)? In theory prediction markets are robust to this. In practice, low-volume prediction markets (like these) aren’t robust against someone willing to spend vastly more resources than everyone else combined and okay with losing all their money, which the friends or enemies of a scandal market target might be. I would be more comfortable with these markets if many people reviewed them frequently, which would make them stop being effectively-low-volume.

I tested this by manipulating a scandal market about Manifold CEO Austin Chen, with his permission. It was originally at 4%; at 4:50 PM California time, I spent M$200 in play money (=~ $2 in real money) to manipulate it up to 95%. By 5:30 California time, it was back down to 4%. This isn’t a great example, because real attackers might be more subtle, make multiple small bets, only try to push it a few percent, etc - but I think it’s a pretty good sign.

And I’m tired of bad things happening, and then learning there was a “whisper network” of people who knew about it all along but didn’t tell potential victims. It’s unreasonable to expect suspicious to come out and make controversial accusations about powerful people on limited evidence. But a prediction market seems like a good fit for this use case.

I’m going to continue encouraging these while thinking of them as experimental and not taking them too seriously.

(I said last week that I would take them seriously, but that was 33% mistake, 33% joke, and 33% knowing that I have more Manifold money than most other people and can just move them back down if they were up for what I thought were unfair reasons)

Short Links

1: Government regulator CFTC is poised to reject Kalshi’s request to host election prediction markets (see also here). I’ve been extra harsh on Kalshi because of allegations that they worked to destroy competitors. But I would look beyond that if I thought they were really going to achieve all of our dreams and create a real legal high-volume prediction market on important questions. This kind of thing is why I’m still pessimistic. Election betting is the bread-and-butter of most prediction markets; Kalshi spent months and rallied a dream team of supporters to beg for permission to do that, and apparently still failed. I think there’s more of a future in play money and cryptocurrency, much as I hate to admit it. Still, I will temporarily put aside my grudge against Kalshi to say that I’m sorry about this and I admire the level of fighting spirit they showed here.

2: Manifold now has a bot that uses an image AI to generate a thumbnail for every market. My favorite pictures are the ones on the scandal markets. For example, here’s how it imagines it would look if Will MacAskill (effective altruist philosopher) committed a scandal:

I almost hope that he does, if only to figure out what role the giant boot plays.

I almost hope that he does, if only to figure out what role the giant boot plays.

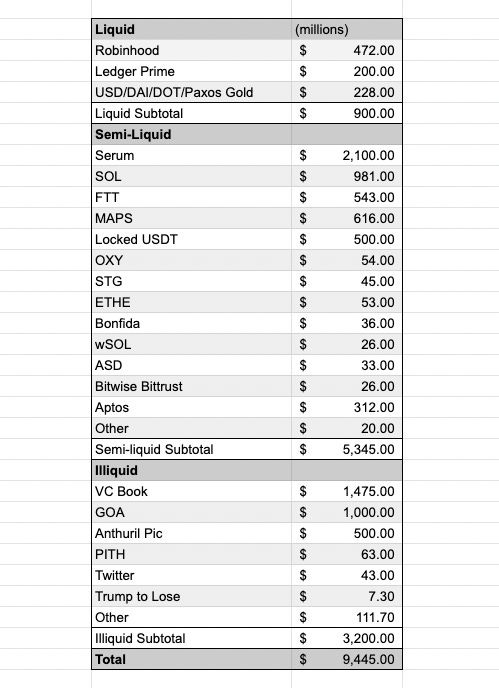

3: Seen on FTX’s balance sheet:

Notice the second-to-last item, “Trump To Lose”. This sounds like a prediction market bet but I don’t know of any real-money market big enough to absorb $7 million on this question - the closest questions on Polymarket have only $1.2 million and $30,000 total. It could have been on a British betting site, but I don’t know details.

4: A story of financial detective work uncovering sinister market manipulation: the market Will [Manifold co-founder] Austin Chen Get A Girlfriend At Any Point In 2022? resolved YES on October 8th. The fourth-most-successful trader on the market is listed as Rachel Weinberg, who won $284 of play money. Rachel’s profile shows she has created questions like Will My Relationship With Austin Last A Year?, suggesting that she is the girlfriend, and made her fake $284 off insider trading! Congratulations to the happy couple.