Why I'm Less Than Infinitely Hostile To Cryptocurrency

Go anywhere in Silicon Valley these days and start saying the word “cryp - “. Before you get to the second syllable, everyone around you will chant in unison “PONZIS 100% SCAMS ZERO-LEGITIMATE-USE-CASES SPEEDRUNNING-THE-HISTORY-OF-FINANCIAL-FRAUD!” It’s really quite impressive.

I’m no true believer. But I’m less than infinitely hostile to crypto. This is becoming a pretty rare position, so let me explain why:

Crypto Is Full Of Extremely Clear Use Cases, Which It Already Succeeds At Very Well

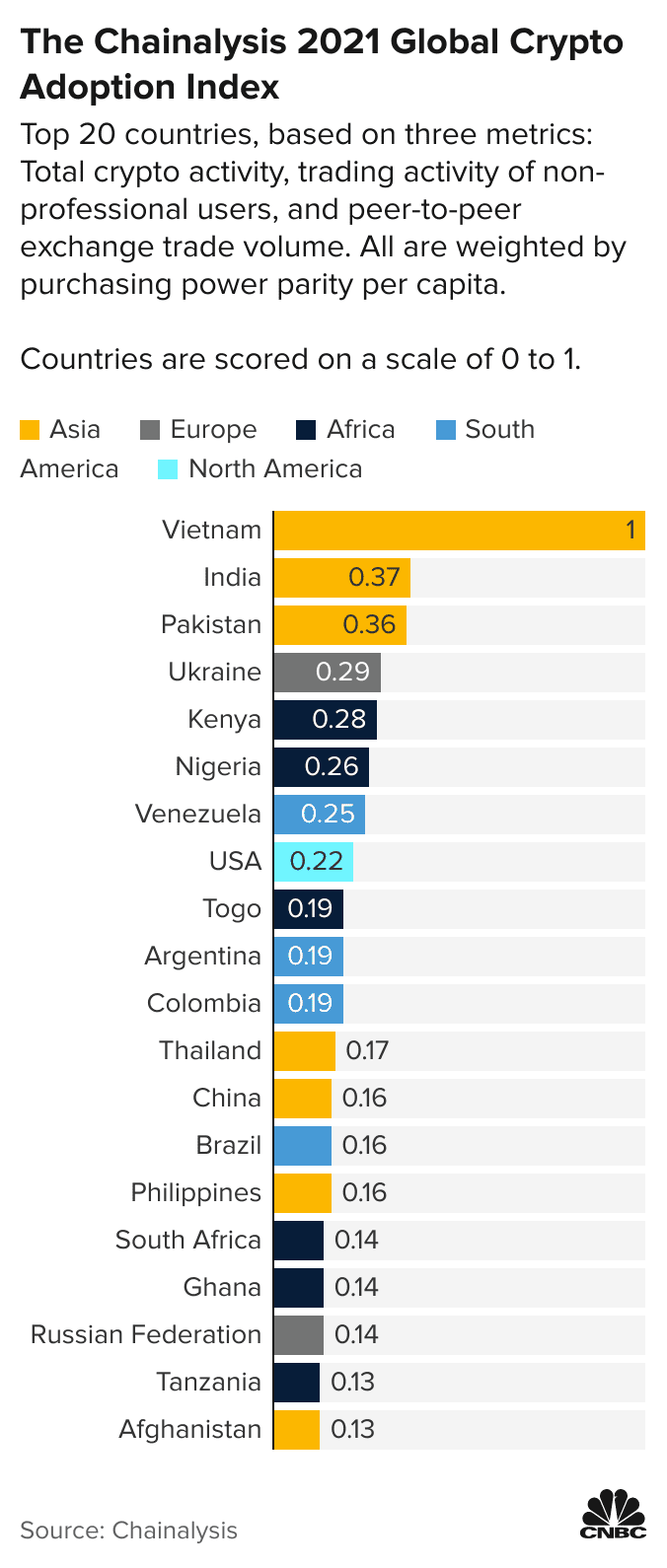

Look at the graph of countries that use crypto the most (source):

Do Vietnamese people love trading monkey gifs? Are Ukrainians especially susceptible to Ponzi schemes? Is Venezuela laden with techbros?

Vietnam uses crypto because it’s terrible at banks. 69% of Vietnamese have no bank access, the second highest in the world. I’m not sure why; articles play up rural poverty, but many nations have more rural poor than Vietnam. There’s a history of the government forcing banks to make terrible loans, and then those banks collapsing; maybe this destroyed public trust? In any case, between banklessness and remittances (eg from Vietnamese-Americans), Vietnam leads the world in crypto use.

Ukraine has always been among the top crypto countries: in 2021, NYT called it “the crypto capital of the world”. Again, this owes a lot to its terrible banking system. NYT describes its banks as “so sclerotic that sending or receiving even small amounts of money from another country requires an exasperating obstacle course of paperwork”, and this guy says that if you deposit more than $100,000 in a Ukrainian bank, “the chance that you get it back is very slim”. When Russia invaded, the Ukrainian government doubled down on crypto as a way for friendly Westerners to donate to the war effort - $70 million as of March. It proved so helpful that during the first month of the war, in between dodging Russian artillery shells President Zelenskyy found time to pass a law legalizing crypto and strengthening its regulatory framework.

Venezuela’s economy has been in slow motion collapse for the past decade. Inflation is currently in the triple digits (remember, people worried the Democrats would lose the midterms because of a US inflation rate of 8%). If your country has a triple-digit inflation rate, you might prefer to use an alternative currency, which Venezuela’s authoritarian government tries to prevent people from doing. Cryptocurrency provides a hard-to-ban alternative which has caught on among Venezuelan hustlers and small businessmen.

I personally contributed in a small way to Russia’s cryptocurrency use. I’ve been trying to help Russian ACX readers escape to other countries to avoid conscription or arrest. Of my two successes so far, both involved sending cryptocurrency to help them afford a ticket out and living expenses while they searched for a job in their new country. I’m pretty proud of this and I don’t think it would have been possible without crypto.

I think a lot of Westerners want to think of developing-world uses as a boring sideshow, and highlight Westerners trading monkey gifs as the only part of crypto worth talking about. But about 66% of crypto users live in the developing world. More people own cryptocurrency in Africa than in North America. Of course a technology centered around avoiding governance and banking failures will be centered in the countries with the most governance and banking failures!

Big Crypto Projects Are Very Rarely Scams

I realize this is a bold sentence to use as a section header in 2022. But I recently tried to figure out the exact scam rate, and it seemed low.

I searched for articles called things like The Top Crypto Projects Of 20XX, and then I checked how many of those projects, years later, had turned out to be scams.I tried my best not to cherry-pick, and to focus on the first article that Google fed me for each of various relevant search terms. I ended up using four articles for this experiment:

…which between them described 54 different crypto projects1. Looking back at these from our position in late 2022, as best I can tell zero of them have been revealed to be outright rug-pull-style scams. A few fizzled out for lack of interest, like any business can. Two of the ten stablecoins lost their pegs, going to 70 - 80 cents instead of the expected $12. One exchange got in trouble for money laundering, although this didn’t negatively affect users. But overall this doesn’t seem worse than any other industry.

If you split $1000 and invested it equally in all the top crypto projects of 2015, you would now have $25,400. If you invested it in the biggest cryptocurrencies by market cap of 2020, you would have $2,700. Stablecoins aren’t really an investment, but if you put it in the top stablecoins of 2020 anyway, you would have $964.30. Exchanges definitely aren’t an investment, but if you put your $1000 in the best crypto exchanges of 2020, I think it would all still be there (FTX wasn’t on the list; maybe it’s too new).3

So why do people think everything in crypto is a scam?

Crypto is a few hundred interesting projects, plus a long tail of thousands of scams. If you’re a knowledgeable person using crypto for some legitimate reason, you’ll use some well-regarded crypto platform and probably not get scammed. If you live in a developed country with a good banking system, and you have no legitimate use cases, your engagement with cryptocurrency may be entirely through clicking on spam emails that say “MAKE 1000% MONTHLY RETURNS WITH MOONCOIN” and wiring them your life savings. In this case you will definitely get scammed. Depending on which of those two categories people are in, and which of those two categories the media covers, you can end up thinking crypto is 100% scams or 0% scams.

This isn’t so different from other fields like education. There are 8 Ivy League schools in the US, 400 high-quality research universities, and about 1,000 fraudulent diploma mills. Higher education is full of scams! If you’re a knowledgeable person following a normal educational track, you’ll probably be fine. If you click on spam emails that say “GET A PHD IN TWO WEEKS WITH THE UNIVERSITY OF PHEONIX” and wire them your life savings, you won’t be fine. I’m not blaming the scamees here - they’re usually poor people who lack the tacit knowledge that the upper class use to navigate the education system. But if you do have that tacit knowledge, and you stick to doing things the slow way without taking any too-good-to-be-true deals, you don’t have to worry about scams that much. This is also how I feel about crypto4.

Crypto Is Valuable Insurance Against Authoritarianism

6259 writes: there are no other rights in substance without the freedom to transact.

That is: Freedom of speech is hollow if you can’t pay the print costs for your magazine. Freedom of religion is hollow if you can’t pay the rent on your church. The freedom to protest is hollow if you can’t pay bus fare to the protest site.

If the government hates Islam, it’s hard from a legal and PR perspective to imprison imams or ban the Koran. But it’s easy to subtly convey to banks that it will regulate them out of existence unless they ban transactions to imams, or to any bookstores that carry Korans. And this has pretty much the same effect.

The most obvious example of this is the way Paypal bans sex workers (including sometimes confiscating the money in their accounts). I don’t think the CEO of Paypal is personally a prude. I think he’s afraid that he’ll get in trouble with the government if he looks like he’s soft on “public indecency”. Without any official diktats that could become a Supreme Court case, the government successfully makes sex work punishingly hard.

Recently I’ve seen this expand from sex work to erotic fiction to medical marijuana to expressing opinions dubbed “misinformation”. One weird supplement company I liked almost had to shut down, not because the government said anything they were selling was illegal, but because payment processors thought it was the kind of thing that someone wouldn’t like, and refused to take their money. I don’t think the CEO of Visa is personally opposed to weird supplements, I think it’s the same kind of soft government collusion that’s been revealed to be going on at Twitter and Facebook and everywhere else.

This tactic reached a new level during the 2021 Ottawa protests, where the Canadian government told banks to freeze the accounts of suspected protesters. All of a sudden their families couldn’t afford food and they had to back down. This is a very effective anti-protester tactic, and there’s no reason that governments who don’t like people protesting them (eg all governments) shouldn’t try it in the future.

(also: CBDCs)

“Oh, so you’re one of those annoying libertarians?” Maybe! But I’ve donated to enough Democrats to get spam texts from Nancy Pelosi. And a lot of them say things like “our democracy is in danger” or “this could be our last free election ever” . If you really think January 6 was a close call, where do you think we’d be if Trump had succeeded? Would he have just passed a few more tax cuts and built a few more miles of border wall? Or would he have actually done the fascism thing? And if he actually did the fascism thing, do you think he would have shown more restraint than the Canadians, and backed down from freezing bank deposits as a weapon against protesters?

If Nancy Pelosi’s text messages are any guide, Democrats have joined libertarians in the “actually pretty worried about the government becoming an oppressive dictatorship” club. I don’t think they can say with a straight face that there’s no chance that we ever get fascists who use financial repression as a tool of control. So they better have a plan. Crypto is the best-developed one I know. Or if you’re still not concerned about the US, at least be concerned about Saudi Arabia or Venezuela or Russia or Iran, where there are already authoritarian governments and people are already using crypto to try to get around them.

Governments can take lots of actions against crypto. They can ban it. They can prevent banks from accepting it. They can search the blockchain to hunt down users. But governments take lots of actions against protests, tax evasion, and drugs, and those things still often succeed. The point isn’t that governments can’t ban a thing and send police after anyone who does it. The point is that there are only so many officers and detectives. If you make something too annoying to crush, the government will put in a half-hearted effort but mostly redirect resources elsewhere.

Yes, The Crypto Financial System Is Just Reinventing The Regular Financial System Except Worse In Every Way, And That’s Fine

The space program has existed for more than fifty years, and mostly succeeded at reinventing things we already have on Earth, only worse. Remember the story of that special astronaut pen that cost $1 million? We already have pens on earth, for like $0.10, and they work better! The lunar rover is just a car, only worse. That robocopter that flew around Mars is just a drone, only worse. We spent $100 billion building the International Space Station, which is basically just a big house in space. But we already have houses on Earth which are cheaper and more comfortable in every way!

The only excuse for any of this is: yes, but it’s in space.

In the same way, everything about the crypto economy is worse than the regular economy. The only excuse is that it’s decentralized. This means you can use it for all of those cool things - sending remittances, circumventing corrupt banking systems, resisting authoritarian governments - that are hard to do with regular money. Of course subjecting yourself to a difficult constraint is going to be harder than not doing that! You don’t hate the International Space Station for being worse than houses on Earth. You marvel at the fact that anyone can live in space at all!

If nothing’s wrong with your country’s financial or political system, then you don’t need crypto. If you use crypto anyway, it will be worse than your regular financial system, because it’s trading off many things you need (efficiency, speed, safety, the good kinds of regulation) for something you don’t need (avoiding the bad kinds of regulation).

Over the past ten years, crypto has advanced. In 2010, it was probably 100x worse than the regular financial system. Now it’s maybe only 10x worse. Might there come a day when it’s no worse at all, or even better? I don’t know. I wouldn’t hold my breath, and I don’t think the utility of crypto depends on it. But who knows? It could happen!5

You, Too, Can Be Less Than Infinitely Hostile To Crypto

Crypto is an interesting technology that had one terrible piece of bad luck: its standard-bearer, Bitcoin, went up in value 10,000x over a few years.

When something goes up in value 10,000x, it’s hard to think of it in any other context. Whatever it was before, now it’s “that thing which went up in value 10,000x”. And so both crypto believers and detractors have treated crypto primarily as a thing for going up in value6. Believers are excited that it did go up that much, hope it might go up more, and fall for a thousand scams that promise continuing going-up. Detractors correctly point out that buying things only insofar as they go up in value makes them Ponzis, and mock crypto for not having gone up in value enough recently.

This post is emphatically not intended as a claim that crypto will go up more, or that it won’t go down a lot, or that there won’t be any more disasters or scams7. It’s a claim that aside from its going-up ability, crypto is still a set of interesting technological solutions to regulatory problems. They’re already solving some problems, and maybe later they’ll solve more.

If you’re in a developed country, and you’re happy with your banking system, and you’re not a sex worker, and you have zero concerns about your country being taken over by fascists, you probably don’t need cryptocurrency and shouldn’t worry about it. If other people say they do need it, don’t call them liars and say you know with certainty that nobody has ever used crypto for anything besides Ponzi schemes and monkey pictures. Just let them use it!

The saying goes: a book is a mirror; if a monkey looks in, no apostle looks out. Cryptocurrency is like this too. If people are looking in and only seeing the monkey gifs, that’s not crypto’s fault.

That’s fine. If we ever reach the Glorious Interstellar Future, we’ll owe it to a space program funded mostly by dick-measuring contests between superpowers, dick-measuring contests between billionaires, and Congressional pork barrel spending. Many of the good things we have now were started were for stupid reasons. I live in a country founded by people who were angry about tea taxes, built on land discovered by people looking for a quicker way to get pepper. If crypto also does good things for bad reasons, then I accept the mild embarrassment that this might cause the Vietnamese as they enjoy their safe and convenient currency deposits.

-

Technically 57, but I excluded three non-dollar stablecoins to make comparing the stablecoins easier.

-

One of the stablecoins counted as “not losing their pegs” here is Tether, which everyone including me suspects is at least kind of a scam. But somehow nothing has gone wrong so far , so it’s not showing up as a scam in the statistics. Still, feel free to count it that way if you want, in which case the scam rate would go up to 1/54, and the expected stablecoin depeg rate would go to 3/10.

-

I’m not focusing on investment returns in order to claim that crypto is a good investment (it was a good investment ten years ago, but you already knew that). I’m focusing on this because if most crypto projects were scams and Ponzis, you would expect people who invested in them to do poorly, whereas in fact the opposite is true. Some of this is that a few cryptos did very well (eg Ethereum) and drowned out the rest doing badly. But even in 2020 when Ethereum’s gains were mostly played out, on average you would have done fine.

-

The one big exception was FTX - I think people did think of it as one of the good ones, and would have included it in lists like these if it had been around a little earlier. But this is why I disagree with people who said it should have been “obvious” it was a scam - it was in a reference class where scams are actually very rare!

-

I’m sort of eliding an awkward point here, which is that some of the reason crypto can make these technological advances is that people are pouring a lot of money into it. And although some of these people are interested in helping the Vietnamese get a trustworthy banking system, realistically a lot of them are interested in Number Go Up.

-

Conflict of interest notice / I am dumb alert: I do hold some cryptocurrency, mostly Ethereum, mostly because I received it a while ago as crypto, and want to wait until the end of the bear market before selling it.

-

I assume there will be another giant crypto scam disaster, and thousands of people will yell at me “DIDN’T YOU SAY CRYPTO PROJECTS AREN’T SCAMS?! NOW THIS IS YOUR FAULT!!” No, I said that most well-regarded crypto projects aren’t scams. But if you wander into crypto with zero foreknowledge and pick some particular one advertising heavily to people like you, that one will very likely be a scam, and certainly some products will be scams. If you want a prediction that you can get mad at me if it fails, the prediction is that if you find a list of the best crypto projects of 2022 by someone focusing on something other than their ability to number-go-up, those ones mostly won’t be scams. If you want a concrete prediction: 90% chance that fewer than one third of the projects listed on this Best New Crypto Projects Of 2022 list are generally regarded as having been scams by 2030 (this doesn’t mean they won’t fail, or go down in value, or that you can never write a sentence accusing them of being bad in some way, just that they’re not going to rug-pull anyone or collapse in a way they claimed there was no chance they could do).